In addition to simplifying payroll the payroll calculator helps you know how much you owe the CRA at the end of each month. Late or non-payment remittance Late filing information return.

When and how to send us CPP contributions EI and income tax deductions report a nil remittance correct a remittance.

Payroll deductions cra. Just writing that paycheque isnt enough though you also have to withhold your employees payroll deductions remit them to the Canada Revenue Agency CRA and take care of more paperwork than you might expect. New employers must first open a payroll program account in order to remit deductions to the CRA. You can use an online payroll calculator like the CRAs Payroll Deductions Online Calculator to find the appropriate amounts for your CPP contributions EI premiums and income tax deductions.

Penalties are assessed for. Employers can remit their payroll deductions to the Canada Revenue Agency by way of mail or online. CRA notes The reliability of the calculations produced depends on the accuracy of the information you provide.

Payroll penalties are assessed for errors in calculation deductions paying remitting or filling. The digital versions of the guide continue to be available on our website at canadacapayroll. You should however note that maximum earnings and contributions for CPP and EI change annually.

CRA payroll deductions include. Payroll deductions include Employment Insurance EI premiums Canada Pension Plan CPP contributions and income tax. How and when to pay remit source deductions.

My Business Account is the CRA portal where businesses can register and file their source deductions online. 2020 2021 Payroll Calendar payroll deductions calculator cra Payroll Calendar ADP payroll deductions calculator cra Payroll Calendar ADP payroll deductions calculator cra 2021 Payroll. As an employer youre responsible for withholding and remitting a portion of employees wages for taxes and contributions.

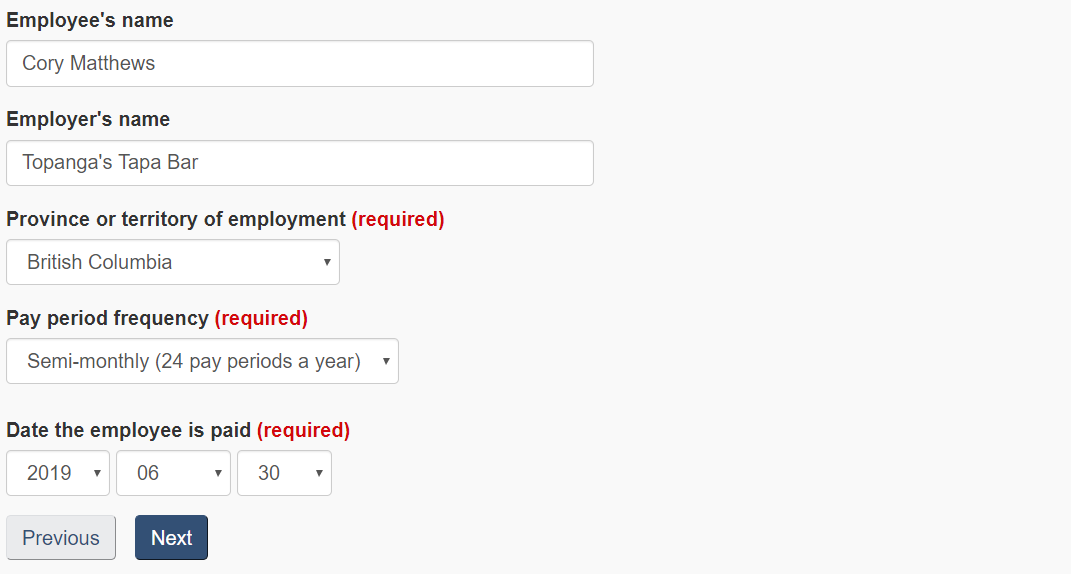

How to use a Payroll Online Deductions Calculator. Effective with the January 1 2017 edition the Canada Revenue Agency is no longer publishing the paper and CD versions of the Guide T4032 Payroll Deductions Tables. Inaccurate calculation or deduction.

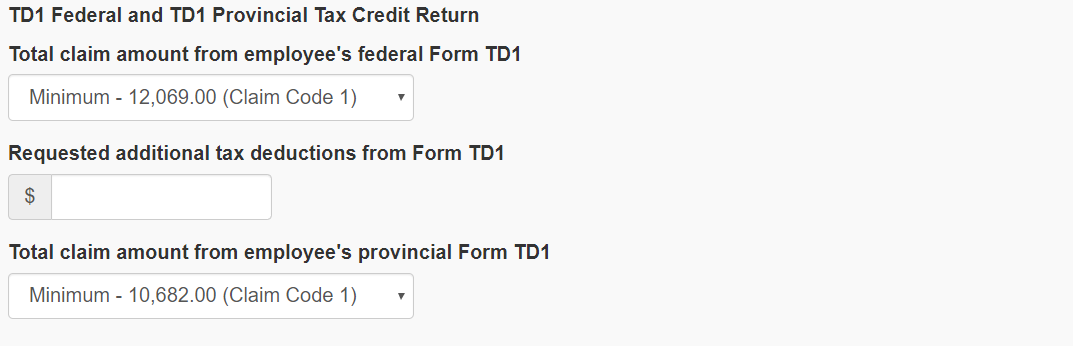

If you do not pay an amount that is due the CRA may apply interest from the day your payment was due. Next the employer will have to ask the employee to provide his or her social insurance number and complete Form TD1Personal Tax Credits Returns. 2020 2021 Payroll Calendar Payroll Deductions Calculator Cra Payroll Calendar ADP Payroll Deductions Calculator Cra Payroll Calendar ADP Payroll Deductions Calculator Cra 2021 Payroll.

Pay remit source deductions. The CRAs own p ayroll deductions online calculator can be used to calculate federal provincial except for Quebec and territorial payroll deductions. As an employer in Canada the Canada Revenue Agency CRA requires that you remit file payroll taxes accurately and on time.

Employers must meet specific remittance deadlines each year. In this post well outline the types of payroll deductions you need to make along with which kind of remittance schedule youll need to follow. A payroll deductions online calculator lets you calculate federal provincial and territorial payroll deductions for all provinces and territories except Quebec.

This page is for employers and provides links to the current and previous years of T4032 Payroll Deductions Tables including the Federal Provincial and Territorial Income Tax Deductions the Employment Insurance premiums and the Canada Pension Plan contributions.

The Canada Revenue Agency CRA allows Taxpayers to deduct business-use-of-home self-employed or workspace-in-the-home employee expenses from your income which lower the amount of taxable income being claimed which reduces the overall tax burden. Any advertising paid for on foreign websites or other mediums cannot be claimed as deductions.

The Tax Series Tax Deductions For Self Employed Canadian Healthcare Professionals Youtube

The Tax Series Tax Deductions For Self Employed Canadian Healthcare Professionals Youtube

Check Out Self On eBay.

Self employed tax deductions canada. Ad Search Filing Taxes Self Employed. These are the three government forms every self-employed Canadian needs to be familiar with. If you are self-employed the Canada Revenue Agency allows you to deduct a range of business expenses.

Office and general supplies. If you are operating a sole proprietorship this is a reasonably simple process. However to claim back such expenses you will need to meet specific criteria covering Canadian content and Canadian ownership requirements.

Ad Search Filing Taxes Self Employed. The remaining portion can be deducted in the year the payment relates to. This means that we consider you to have sold the assets at a price equal to their FMV at that time.

Moreover you can lower your average tax rate and thus your tax bill even more by taking advantage of other personal tax deductions and tax credits such as claiming some of your RRSP contributions as deductions. Youll also need to fill out Form T2125 to list your deductible business expenses. When youre self-employed these deductions can have a big impact on your bottom line by reducing the amount of tax that you have to pay.

Business revenue is the total amount of income your. Get Results from 6 Engines at Once. These expenses offset your income lowering your profits on paper and reducing your tax burden.

Your home office is to be either your principal place of business meaning that it is used more than 50 of the time for business purposes or used exclusively for purpose of earning business income. The following is a list of the most common self-employment tax deductions. They can deduct the cost of the extra food and beverages they must consume in a normal working day 8 hours because of the nature of their work.

There are two major criteria to fulfill to be able to claim deductions for your home office expenses. Bank fees and interest charges. Here is a look at the main deductions you can claim.

Ad Get Self With Fast And Free Shipping For Many Items On eBay. Check Out Self On eBay. Ad Get Self With Fast And Free Shipping For Many Items On eBay.

But Did You Check eBay. This information is for self-employed. What are some common self employed tax deductions in Canada.

Once you decide to start a business whether it be part time or full time there are a number of expenses that are deductible from the income you earn. So you file your tax return with Form T1 as personal income. Extra food and beverages consumed by self-employed.

If you pay an amount relating to more than one year you can only deduct the portion of the payment that relates to the current tax year. Get Results from 6 Engines at Once. On Form T2125 expect to provide the following.

The T2125 also provides self-employed Canadians with the opportunity to deduct allowable expenses from your gross income to lower your taxable income so you pay less in income taxes. But Did You Check eBay. The tax act provides some guidelines as to what can and cannot be deducted but these guidelines are limited to a few specific items.

Licenses and business subscriptions. Legal and accounting fees. Lets say youre a self-employed web designer in Ontario and you earned 100000 in business revenue.

Self-employed tax deductions can cover a part of your advertising and marketing costs too. If youre self-employed you dont actually pay business income tax. The Income Tax Act requires that you transfer these assets to the business at their fair market value FMV.

The daily flat rate that can be claimed is 23.

You can also use it to calculate the required deductions for Quebec such as the Québec Pension Plan and Employment Insurance at the prescribed rate for Quebec. Collections activities will resume in February 2021.

You may send the CRA payment once per quarter or you may need to send the funds four times a month.

Cra payroll deductions. You can use an online payroll calculator like the CRAs Payroll Deductions Online Calculator to find the appropriate amounts for your CPP contributions EI premiums and income tax deductions. Once youve collected deductions from your employees you need to send them to the CRA. To help you the CRA website provides an online calculator that can be used to calculate federal provincial and territorial payroll deductions.

Use the Payroll Deductions Online Calculator PDOC to quickly calculate federal and provincial payroll deductions. In simple terms remittance is the filing of payroll deductions to the Canadian government. A two-year history of your AMWA is used to classify you as a new regular accelerated or quarterly.

Before you even hired your first employee you set up your payroll account with the CRA. With only a few simple clicks you can automate your tax calculations and add templates. CRA notes The reliability of the calculations produced depends on the accuracy of the information you provide.

2020 2021 Payroll Calendar Payroll Deductions Calculator Cra Payroll Calendar ADP Payroll Deductions Calculator Cra Payroll Calendar ADP Payroll Deductions Calculator Cra 2021 Payroll. 2020 2021 Payroll Calendar Cra Payroll Deductions Calendar Payroll Calendar ADP Cra Payroll Deductions Calendar Payroll Calendar ADP Cra Payroll Deductions Calendar 2021 Payroll Templates Payroll Calendar 2021. Employers can remit their payroll deductions to the Canada Revenue Agency by way of mail or online.

Form TD1-IN Determination of Exemption of an Indians Employment Income. Youll need to determine what kind of remitter you are. The CRAs own p ayroll deductions online calculator can be used to calculate federal provincial except for Quebec and territorial payroll deductions.

Form TD1X Statement of Commission Income and Expenses for Payroll Tax Deductions. You should however note that maximum earnings and contributions for CPP and EI change annually. As a business your remittance schedule for payroll deductions is determined by your average monthly withholding amount AMWA the sum of all the payroll deductions you paid to the CRA within a calendar year averaged on a monthly basis.

Guide RC4110 Employee or Self-employed. How do you Remit Payroll Deductions to the CRA. Calculations cover all Canadian Provinces Federal Quebecs Federal Quebec.

The Canada Revenue Agency CRA makes it mandatory for all employers and other people that make employee-related payments in Canada to deduct income taxes as well as CPP contributions and EI premiums from the income or remuneration paid to employees. My Business Account is the CRA portal where businesses can register and file their source deductions online. Eligible employers can apply for a subsidy equal to 10 of the remuneration that would be provided to each eligible employee from March 18 2020 to June 19 2020.

Excelling Payroll is the complete Excel Canadian tax deduction add-on for Federal Tax Provincial CPP QPP and EI updated to Canadas current tax rates effective January 1st 2018. Temporary wage subsidy for employers. Guide RC4157 Deducting Income Tax on Pension and Other Income and Filing the T4A Slip and Summary.

These calculations can be made easily using a Payroll Deductions Online Calculator PDOC. Let us inform you To get quick and easy access to new payroll deductions tables and other recently announced tax information you can subscribe free of charge to one or more of these electronic mailing lists.