Get Results from 6 Engines at Once. You must file when.

Ifta Fuel Tax Report Supplement Form Vincegray2014

Ifta Fuel Tax Report Supplement Form Vincegray2014

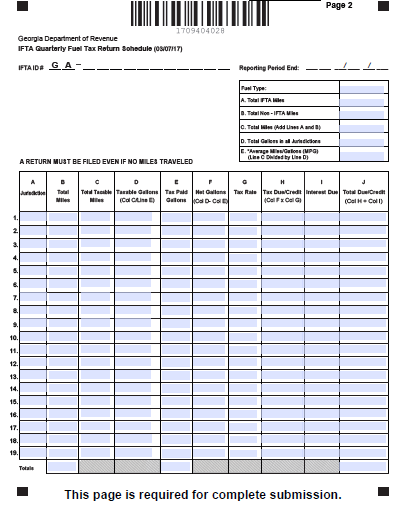

You are required to electronically file your International Fuel Tax Agreement IFTA returns.

Ifta tax return. Get A 100 Accuracy Guarantee With HR Block for your US. If youre a New York-based IFTA carrier use IFTA Web File to e-file and pay your IFTA quarterly return. You dont have any mileage to report mark No operation on the tax return you travel only in Washington there is no payment due.

Enter the Total IFTA Miles traveled in IFTA jurisdictions by all qualified motor vehicles in your fleet using the fuel indicated. Taxes Online Or With An Expat Advisor From Anywhere In The World. Taxes Online Or With An Expat Advisor From Anywhere In The World.

Ad Search 2017 Federal Tax Return. When your company operates qualified motor vehicles that cross state lines you are required to obtain an International Fuel Tax Agreement IFTA License or obtain a 120-hour fuel permit. Your IFTA credentials must also be returned or a notarized letter stating they have been destroyed will need to be submitted.

The Ministry of Finance will mail an IFTA tax return to you at least 30 days before each due date. If the above dates fall on a weekend or. You must file your quarterly returns by.

In order to report taxes correctly the licensee must view print or download the applicable tax rates for the quarter being reported. Get Results from 6 Engines at Once. IFTA Tax Reporting Requirements.

File a Return. Each tax quarter the licensee must complete and file an IFTA tax return and Schedule 1. As an IFTA member you must complete and file an IFTA tax return every 3 months.

Even if you are due a net refund interest still applies to each jurisdiction for any underpayment of fuels use tax to that jurisdiction. The International Fuel Tax Agreement IFTA is an agreement among jurisdictions United States and Canadian provinces to simplify the reporting of the fuel use taxes by interstate carriers. On your IFTA tax return you will report how much tax-paid fuel you purchased and the distance travelled in each jurisdiction.

Once you are licensed under the IFTA Program DMV will mail a tax return form to you each quarter. Get A 100 Accuracy Guarantee With HR Block for your US. Your work will not be saved.

IFTA streamlines paperwork and compliance burdens for reporting fuel tax liability for gasoline diesel propane blended fuels gasohol or ethanol liquified. ESystemsWebfile will time out after 30 minutes of inactivity. If you have any questions regarding filing your IFTA return electronically visit our frequently asked questions or contact us.

South Dakota charges a late penalty of 50 or 10 of the net tax due whichever is greater. Well mail pre-printed quarterly IFTA tax returns which include barcoded information to active account holders. Ad Its Easy To File US.

The IFTA program allows all states and participating Canadian provinces to collect fuel taxes on behalf of all participating jurisdictions based on total distance operated in all jurisdictions using quarterly. To close the account you must first complete and file any outstanding tax returns and submit any tax due the State of Florida. Form IFTA-100 IFTA Quarterly Fuel Use Tax Return Web File is freeno additional software needed.

Ad Its Easy To File US. Interest is computed on overdue taxes in each jurisdiction at a rate of4167 per month. You will balance overpayments in one jurisdiction against amounts owed in.

If your return results in a balance due you have the choice to pay by credit card or make an electronic payment ACH Debit. Log on to file your IFTA return. Ad Search 2017 Federal Tax Return.