If you are an SLFI that reports both the GSTHST and QST you can file your combined GSTHST and QST return Form RC7200 using My Business Account Represent a Client or GSTHST NETFILE. GSTHST NETFILE and GSTHST TELEFILE allow individuals to file their sales tax returns directly online and are the quickest and easiest options to use.

Http Www Ritatullycpa Com Wp Content Uploads 2016 02 How To File Gst Online Pdf

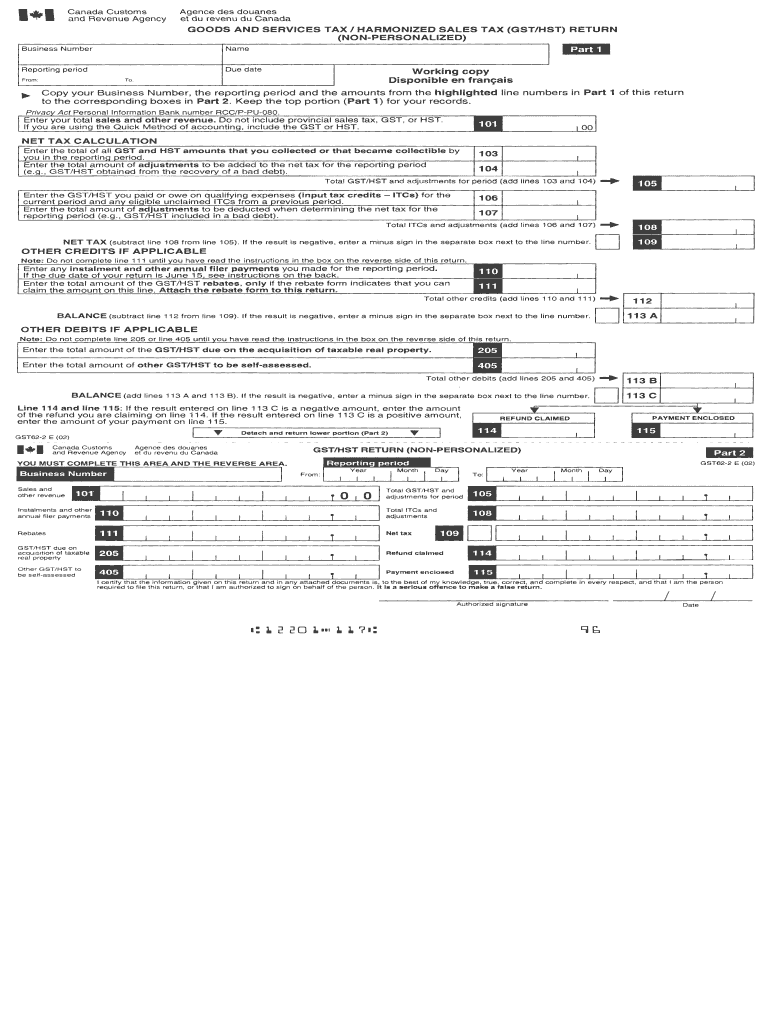

Enter 750 on line 105 if you are filing your return electronically or on line 103 if you are filing a paper GSTHST return 60 of the 1250 GST collected.

Gst hst netfile ready to file. Step 2 You can claim ITCs for the GST you paid for the ventilation system improvement to real property and for the computer equipment capital property purchase that you intend to use. Even without a My Business Account you can filing via GST Netfile so long as you have your 4-digit Web Access Code WAC. If you are not required to file online you may be eligible to file a paper return.

Form RC158 GSTHST NETFILETELEFILE Remittance Voucher to make your payment. There are two ways of filing your GST HST. GSTHST NETFILE is an online filing service that allows registrants to file their GSTHST returns and eligible rebates directly to the Canada Revenue Agency CRA over the internet.

Should I claim this credit amount under Refund of GST paid in prior years under Income from GSTHST or QST reb. If you are filing on paper be sure to include your Business Number and report period dates to ensure quick processing of your return. If you are closing a GSTHST account you need to file a.

As previously stated above the My Business Account is also available for filing sales taxes alongside other business-related taxes. The reporting period and confirmation number from a return filed using GSTHST NETFILE TELEFILE or Internet File Transfer. The due date of your return is determined by your reporting periodWe can charge penalties and interest on any returns or amounts we have not received by the due date.

Filing GST-HST Via NetFile. Tax Resources for Small Business. This credit started and stopped by itself.

GSTHST Internet File Transfer GSTHST Internet File Transfer is an internet-based filing service that allows eligible registrants to file their GSTHST returns directly to the CRA over the internet using their third-party accounting software. You can either fill out the form and mail in your details to the CRA. Add line 103 and line 104 and enter the result on line 105If you file a paper return enter this amount on Part 1 and Part 2 of the return.

How to file your GSTHST Return online using the CRAs Netfile system. In order to access the CRA service simply follow the link. Please note that the session is secured and will expire after 15 minutes of inactivity.

I never claimed this amount in prior years income tax return. The best way to file for your GST netfile or HST is to use the netfile service the CRA provides. Or two you can file for your GST netfile and HST netfile online.

When you are ready to file your return select the Ready to file button. If you provide the Ontario First Nations point-of-sale relief the amount of HST collected or collectible on the supply must be included in the line 105 calculation at the full 13. The personalized GSTHST return Form GST34-2 will show the due date at t he top of the form.

Line 105 Total GSTHST and adjustments for the period. Generally we process as the GSTHST return as follows. When filing on paper do not use Form RC158 to make your payment.

In Quebec Revenu Québec administers the GSTHST with the exception of selected listed financial institutions SLFIs that report both the GSTHST and QST. The team at Ashton Tax arent only experts in corporate tax filing payroll budgeting and financial planning but also can help you navigate the complicated world of the CRA Canada Revenue Agency. I received a GSTHST credit in 2019 and some in 2020 and suddenly it stopped now.

You should have received your Access Code in an earlier mailing from the Canada Revenue Agency but be aware that some Access Codes only work with a specific returnfiling period and you need a. Send file the return What is the due date to file a GSTHST return. GSTHST NETFILE If this is your first time using the service we recommend that you review the links under Topics for GSTHST NETFILE below.

GSTHST NETFILE is an Internet-based filing service that allows registrants to file their goods and services taxharmonized sales tax GSTHST returns and eligible rebates directly to the Canada Revenue Agency CRA over the Internet. Developing a financial plan in order to ensure GST HST payment dates are followed through with and other corporate tax services by Ashton Tax team. In two weeksif you filed electronically in four weeksif you filed a paper return Ifyou have notincluded all the necessary information and completed your return correctly processing of your refund could be delayed.