Get Results from 6 Engines at Once. You must file when.

Ifta Fuel Tax Report Supplement Form Vincegray2014

Ifta Fuel Tax Report Supplement Form Vincegray2014

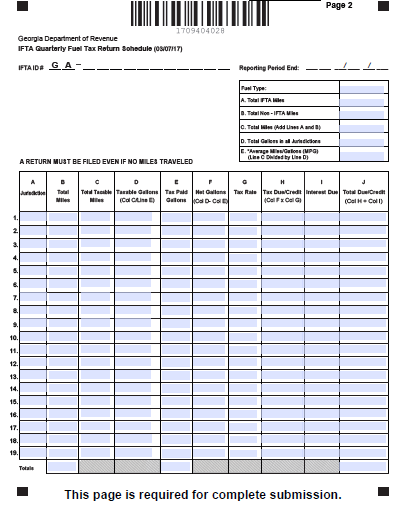

You are required to electronically file your International Fuel Tax Agreement IFTA returns.

Ifta tax return. Get A 100 Accuracy Guarantee With HR Block for your US. If youre a New York-based IFTA carrier use IFTA Web File to e-file and pay your IFTA quarterly return. You dont have any mileage to report mark No operation on the tax return you travel only in Washington there is no payment due.

Enter the Total IFTA Miles traveled in IFTA jurisdictions by all qualified motor vehicles in your fleet using the fuel indicated. Taxes Online Or With An Expat Advisor From Anywhere In The World. Taxes Online Or With An Expat Advisor From Anywhere In The World.

Ad Search 2017 Federal Tax Return. When your company operates qualified motor vehicles that cross state lines you are required to obtain an International Fuel Tax Agreement IFTA License or obtain a 120-hour fuel permit. Your IFTA credentials must also be returned or a notarized letter stating they have been destroyed will need to be submitted.

The Ministry of Finance will mail an IFTA tax return to you at least 30 days before each due date. If the above dates fall on a weekend or. You must file your quarterly returns by.

In order to report taxes correctly the licensee must view print or download the applicable tax rates for the quarter being reported. Get Results from 6 Engines at Once. IFTA Tax Reporting Requirements.

File a Return. Each tax quarter the licensee must complete and file an IFTA tax return and Schedule 1. As an IFTA member you must complete and file an IFTA tax return every 3 months.

Even if you are due a net refund interest still applies to each jurisdiction for any underpayment of fuels use tax to that jurisdiction. The International Fuel Tax Agreement IFTA is an agreement among jurisdictions United States and Canadian provinces to simplify the reporting of the fuel use taxes by interstate carriers. On your IFTA tax return you will report how much tax-paid fuel you purchased and the distance travelled in each jurisdiction.

Once you are licensed under the IFTA Program DMV will mail a tax return form to you each quarter. Get A 100 Accuracy Guarantee With HR Block for your US. Your work will not be saved.

IFTA streamlines paperwork and compliance burdens for reporting fuel tax liability for gasoline diesel propane blended fuels gasohol or ethanol liquified. ESystemsWebfile will time out after 30 minutes of inactivity. If you have any questions regarding filing your IFTA return electronically visit our frequently asked questions or contact us.

South Dakota charges a late penalty of 50 or 10 of the net tax due whichever is greater. Well mail pre-printed quarterly IFTA tax returns which include barcoded information to active account holders. Ad Its Easy To File US.

The IFTA program allows all states and participating Canadian provinces to collect fuel taxes on behalf of all participating jurisdictions based on total distance operated in all jurisdictions using quarterly. To close the account you must first complete and file any outstanding tax returns and submit any tax due the State of Florida. Form IFTA-100 IFTA Quarterly Fuel Use Tax Return Web File is freeno additional software needed.

Ad Its Easy To File US. Interest is computed on overdue taxes in each jurisdiction at a rate of4167 per month. You will balance overpayments in one jurisdiction against amounts owed in.

If your return results in a balance due you have the choice to pay by credit card or make an electronic payment ACH Debit. Log on to file your IFTA return. Ad Search 2017 Federal Tax Return.

For zero-rated goods and services you dont charge or collect GSTHST but you can still claim ITCs for them on your GSTHST return. On July 1st 2010 HST Harmonized Sales Tax replaced existing 8 PSTprovincial sales taxes and 5.

How To Calculate Hst On New Homes In Ontario

How To Calculate Hst On New Homes In Ontario

5 Federal part and 8 Provincial Part.

Ontario hst return. Taxable Sales including HST 1000 x 113 1130 HST to be remitted to CRA 1130 x 88 9944. Enter 750 on line 105 if you are filing your return electronically or on line 103 if you are filing a paper GSTHST return 60 of the 1250 GST collected. This HST is then remitted by the company to the Canada Revenue Agency CRA when the HST return is filed.

Here are the features of each method. You can file the GSTHST return for your business electronically in various ways depending on your needs and preferences. GSTHST registrants are required to file GSTHST returns on a monthly quarterly or annual basis.

What is the current 2021 HST rate in Ontario. Those rebate forms contain a question asking you if you want to claim the rebate amount on. Include the GSTHST you collected or were required to collect on.

You are completing a paper GSTHST return using the regular method. Some rebates can reduce or offset your amount owing. To help you prepare your GSTHST return use the GSTHST Return Working Copy and keep it for your own records.

Sudbury Tax Services Centre 1050 Notre Dame Avenue Sudbury ON P3A 5C1. How to file your GSTHST Return online using the CRAs Netfile system. Calculating how much GST or HST to remit.

Ad Book your Hotel in Ontario online. For businesses located in Toronto mail the return to. If you want to find out how to get a fast HST return using the Quick Method of accounting for HST go through this article and youll know just what to doht.

A GSTHST provincial rates table as well as a calculator can be found here. Due date for which you are filing the GSTHST return. Enter all GSTHST you were required to collect as well as all amounts of GSTHST collected on your supplies of property and services.

If you have misplaced or never received the tear-off return dont worry. Tips for Filing your Business HST Return in Ontario If youre a small business owner you might just be getting over filing your year-end tax return. Before you choose a method you must determine if you are required to file online and which online method you can use.

If your business has a higher revenue than 30 000 in a single calendar quarter or four consecutive quarters you must register for an HST number in Canada. In Ontario for example where there is HST that 100 bag of pretzels would cost 113 as the HST in Ontario is currently 13. You can file a GSTHST return electronically by TELEFILE or on paper.

When registering for a GSTHST account and in cases where a reporting period is not specified Canada Revenue Agency CRA. The deadline for quarterly HSTGST returns for businesses with. Find your local tax office from this list.

Sales taxes in Ontario where changed in 2010 then instead of GST and PST was introduced Harmonized sales tax HST. This payment should be reported on line 110 of your GSTHST Tax Return. Alberta for example has no provincial sales taxes so a 100 bag of pretzels will cost you 105 at the checkout.

You are completing a GSTHST return electronically. Collecting and remitting GST or HST allows a business to recover the GST or HST it pays on business expenses. File your GSTHST return Form GST34 File your combined GSTHST and QST return Form RC7200 File any applicable schedules with your return.

You will need to provide the business the following. Current 2021 HST rate in Ontario province is 13. Ad Book your Hotel in Ontario online.

But dont rest on your laurels for too long. The reporting period a registrant has determines how often GSTHST returns are required to be prepared during the GSTHST year. Mail your completed return to your local Tax Office.

My Business Account Represent a Client. In Ontario businesses which register with Canada Revenue Agency or which are eligible to register can collect 13 HST from customers and recover the amount of HST they paid on business expenses. Step 2 You can claim ITCs for the GST you paid for the ventilation system improvement to real property and for the computer equipment capital property purchase that you intend to use more than 50 in your commercial activities.

You are completing a non-personalized GSTHST return GST62 You need to complete your personal business information. Calculating HST in Ontario without the Quick Method election. HST charged on sales 1000 x 13 130 HST paid on expenses ITCs 100 x 13 13 HST to be remitted to CRA 130 13 117.

This line does not appear on an electronic return. Normally when you fill out your GSTHST return you can claim Input Tax Credits ITCs to recover the GSTHST you paid or owe on your business purchases andor expenses. However any GSTHST you owe is payable by April 30.

The due date of your return is June 15. History of sales taxes in Ontario.