Residential and farmland owners to receive a. In Manitoba provincial sales tax is called retail sales tax RST and is charged at a rate of 8.

Manitoba Budget For 2019 Klassen Financial

Manitoba Budget For 2019 Klassen Financial

The move brings Manitoba in.

Provincial sales tax manitoba. Manitoba is one of the provinces in Canada that charges separate 7 provincial Retail Sales Tax RST and 5 federal Goods and Services Tax GST. Electricity and Piped Gas. The Retail Sales Tax RST is a tax applied to the retail sale or rental of most goods and certain services in Manitoba.

PST GST and HST. WINNIPEG Inside the Manitoba provincial budget released today was a proviso saying those doing business online no matter where based will have to collect the 7 provincial sales tax from Manitobans and remit it to the province. Digital streaming services such as Netflix and Spotify can expect to be subject to the provincial sales tax as of Dec.

The general sales tax rate is 7. Alberta British Columbia 5 GST British Columbia 12 Manitoba 5 GST Manitoba 12 New-Brunswick Newfoundland and Labrador 15 Northwest Territories Nova Scotia Nunavut Ontario Prince Edward Island Québec GST 5 Québec QST 9975 Québec QSTGST 14975 Saskatchewan 6 PST Saskatchewan 11 Yukon. WINNIPEG Manitobas 2021-22 budget released Wednesday contains some property tax and provincial sales tax breaks but transfers some of the sales tax to other areas.

When combined with the Goods and Services Tax GST Manitobans pay a total of 12 in retail sales tax. General rates of PST vary from 6 to 8. A summary of taxable services is provided in Section 4.

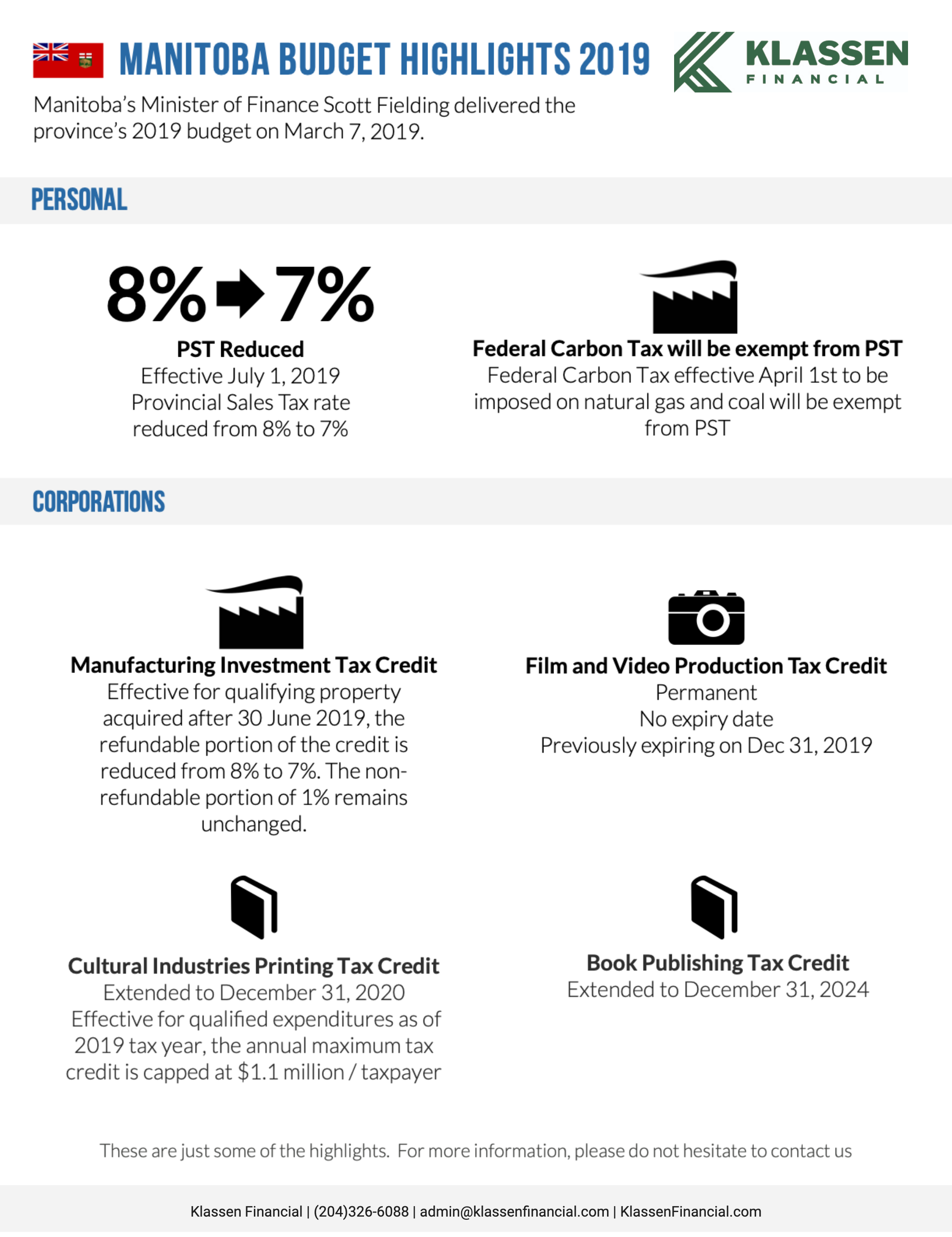

Most goods and services are charged both taxes with a number of exceptions. The provincial sales tax PST in Manitoba is 7. Manitobas PST was reduced from 8 to 7 in July 2019.

The seller solicits the order for sale in Manitoba by any means IE advertising in person etc The seller accepts orders originating in Manitoba. The tax is calculated on the selling price before the GST Good and Services Tax is applied. See below for an overview of sales tax amounts for each province and territory.

There are three types of sales taxes in Canada. 1 as will online accommodation bookings through companies such as Airbnb. The Progressive Conservative governments budget also followed through on two earlier tax promises.

14 rows Separate provincial sales taxes PST are collected in the provinces of British Columbia. Among the tax changes coming to Manitobans in 2021 is the introduction of a provincial retail sales tax for streaming services online marketplaces and online accommodation platforms as. Taxes elsewhere however are increasing.

A summary of items exempted by the Act is provided in Section 3. Beginning in December streaming services online accommodations and online marketplaces will be required to charge provincial sales tax the province announced as part of its 2021-22 budget. As of July 1 2016 the HST rate increased from 13 to 15.

Here are some of the winners and losers. Businesses are to. Sales tax is generally not payable on services unless the service is specified as a taxable service in the Act.

Tax is generally payable on the purchase of most goods except for goods specifically exempted by the Act. Retail Sales Tax. As of July 1 2019 the PST rate was reduced from 8 to 7.

In Manitoba the PST is called the Retail Sales Tax RST and out-of- province businesses will be required to register as a vendor collecting the RST if the following conditions exist. As of July 1 2016 the HST rate increased from 13 to 15. Provinces such as Ontario charge a single harmonized sales tax HST.

The province also plans to cut vehicle registration fees by 10 per cent as of July and is to eliminate the provincial sales tax from spa and salon services starting in December. More money in pockets of Manitobans. One was to start phasing out the education tax on property and the other was to eliminate the provincial sales tax on personal care services such as haircuts.

British Columbia Saskatchewan and Manitoba currently impose a single incidence provincial sales tax PST in addition to the 5 GST on end-users of most tangible personal property and certain services in their respective provinces.