The Harmonized Sales Tax HST is the combination of Federal GST and Provincial PST into a single value added tax. Depending on the province or territory in which you operate your business you need to collect either a combination of GST and PST GST or only HST.

On March 23 2017 the Saskatchewan PST rose from 5 to 6.

Does manitoba have hst. HST applies in the provinces of Ontario New Brunswick Nova Scotia Prince Edward Island and Newfoundland and Labrador. The HST increased 1 for Prince Edward Island on October 1 2016. The HST like the GST is a value-added tax applied to a wide range of goods and services.

Amount HSTGST variable Total Amount. Quebec has a 5 tax on books and Manitoba has a 5 tax on lodging. Under an HST in Manitoba consumers would pay 405 million more in provincial sales tax.

Province On or after October 1 2016 July 1 2016 to September 30 2016 April 1 2013 to June 30 2016 July 1 2010 to March 31 2013 January 1 2008 to June 30 2010. On July 1 2019 the Manitoba PST dropped from 8 to 7. The provinces that charge GST and their own Provincial Sales Tax are.

2British Columbia-If you live in British Columbia you have to paycharge both 5 GST and 7 PST for a total of 12. When Ontario and BC. The provinces of British Columbia Saskatchewan and Manitoba levy provincial sales taxes PST also known as retail sales taxes in their respective jurisdictions.

Currently five provinces Ontario New Brunswick Nova Scotia Newfoundland Labrador Prince Edward Island no longer have a provincial sales tax - they have merged their provincial sales tax with the federal GST and now charge a single Harmonized Sales Tax HST. In Alberta like the territories they do not have HST or a provincial sales tax they just have GST. Alberta British Columbia 5 GST British Columbia 12 Manitoba 5 GST Manitoba 12 New-Brunswick Newfoundland and Labrador 15 Northwest Territories Nova Scotia Nunavut Ontario Prince Edward Island Québec GST 5 Québec QST 9975 Québec QSTGST 14975 Saskatchewan 6 PST Saskatchewan 11 Yukon.

Paskowitz says that Canadian businesses that do not expect to have at least 30000 in annual revenues are not required to have a GSTHST number but you could consider registering for one anyway. In Manitoba provincial sales tax is called retail sales tax RST and is charged at a rate of 8. Getting a bit technical for a moment.

These fall into three categories. Lastly if your customer was based out of Vancouver BC making the place of supply British Columbia then you would charge them 5 GST plus 7 PST. Manitoba-If you live in Manitoba you paycharge both 5 GST and 8 PST for a total of 13.

In 1996 three of the four Atlantic provinces New Brunswick Newfoundland and Labrador and Nova Scotia entered into an agreement with the Government of Canada to implement what was initially termed the blended sales tax renamed to harmonized sales tax which would combine the 7 federal GST with the provincial sales taxes of those provinces. Your accountant can help you figure out exactly which taxes apply to your specific business. Provinces Where Only GST Is Due.

So that means your business may need to collect additional taxes depending on the special taxes in your province and the type of business you run. 14 rows The HST is in effect in Ontario New Brunswick Newfoundland and Labrador Nova Scotia. For purposes of illustration assume you operate a small business in Manitoba selling stained glass ornaments and art objects that youve designed and need to know how to charge RST.

The provincial sales tax in Manitoba is called RST Retail Sales Tax. 4New Brunswick-If you live in New Brunswick you paycharge 15 HST 5 GST and 10 PST. Provinces such as Ontario charge a single harmonized sales tax HST.

As part of this project the PST portion. Harmonize this summer only PEI Saskatchewan and Manitoba will not have the HST. The federal government and all HST provinces provide several forms of offsets to reduce the cost of GSTHST for households.

Manitoba Government departments and entities are exempt from the federal Goods and Services Tax GST and Harmonized Sales Tax HST on direct purchases. As of July 1 2016 the HST rate increased from 13 to 15 for Newfoundland and Labrador and New Brunswick. Merchants in Manitoba are required to pay GST and RST for all sales made.

Canada does not have a formal self-billing program. I actually recommend doing so since non-registered businesses. Not all provinces have HST but the ones that do are.

Below is a list of entities that are exempt from GSTHST on such purchases of property or services. 14 rows HST Total Tax Rate Notes. Please note that the list is subject to change.

Point-of-sale exemptions rebates for new housing and low-income tax credits.

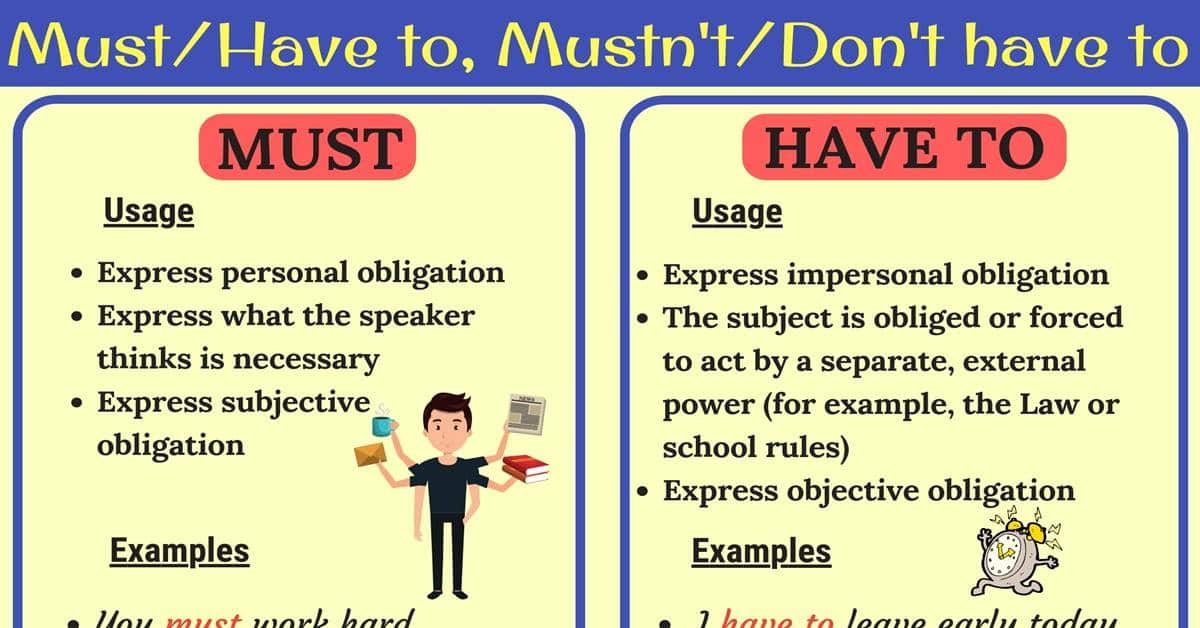

Dont Have to DoNot Required but Possible. Must expresses the speakers feelings whereas have to expresses above all an impersonal idea.

Have to is NOT an auxiliary verb it uses the verb have as a main verb.

Must have to. I must tell him about it. They be in a hurry because they have got more than enough time. Have to mengungkapkan suatu keharusan atau kewajiban yang bersifat umum.

Kita akan mengetahui jawabannya melalui pembahasan tentang cara penggunaan must have to should di bawah ini. Expressing obligation atau menyatakan kewajiban keharusan adalah salah satu fungsi dari must dan have to. You can do this grammar quiz online or print it on paper.

The obligation comes from an external source. Aku harus memberitahukan ini padanya A student has to be polite to the teachers Seorang murid harus sopan terhadap para guru. The meeting is at nineThe obligation comes from the manager.

I must finish this work before I leave. Mus t and have to are both used for obligation and are often quite similar. Must vs have to.

Both Must and have to express obligation or necessity but there are some small differences. We often use have to to say that something is obligatory for example. We use have to must should infinitive to talk about obligation things that are necessary to do or to give advice about things that are a good idea to do.

Must merupakan modal auxiliary verb oleh karena itu tidak membutuhkan dummy auxiliary do untuk interrogative. Have to is a variation of the verb have. In this lesson we look at have to must and must not followed by a quiz to check your understanding.

Have to is used when we want to say that something must happen as it is required by law or circumstances. The speaker thinks its necessary or important to do something. John must explain this if he wants his students to succeed.

I must get going. Auxiliary verbs in English elementary intermediate and adavanced level esl. You are obliged to come I require that you come You have to come.

Sedangkan must mengindikasikan keharusan yang bersifat khusus atau spesifik. I have to go now. Use must to express something that you or a person feels is necessary.

Must you work so hard. In fact it can be said that must and have to are two different words that give different senses and not the same meaning. They are both followed by the infinitive.

This form is used only in the present and future. It is not my decision - my husband asked me to buy them. I had a terrible stomachache You should have gone to the doctors I didnt hear from my father last week.

The speaker thinks it is necessary or it is the rule. You must get up early tomorrow. In this grammar les.

There is a slight difference between have to and must though they both seem to convey the same meaning. Its her birthday and I decide to do that I have to buy flowers for my mother-in-law. Must is known as a modal verb in the English language while have to is a verb.

It tests what you learned on the have to must page. You have to drink enough water Kamu harus minum cukup air. Must Have to.

You are obliged to come. Must dan have to dalam kalimat positive atau interrogative digunakan untuk menyatakan kewajiban obligation atau kebutuhan untuk melakukan sesuatu. I must go now.

Have To vs Must. Subject is obliged to do something. In English we use must and have to to express a strong rule or law.

Must reflects the necessity of doing something as per the given circumstances. Must is a modal auxiliary verb. We include have to here for convenience.

What is necessary in the eyes of the speaker. We normally use must when to talk about obligations that come from the opinion of the speaker. Must and have to - modal verbs exercises.

I can give you my car so you buy a new one. Do we say I must do my homework or I have to do my homework. I must buy flowers for my mother.

We use should have to give or ask for an opinion in the present about something which happened in the past. Tim take his umbrella. Yesterday I ________ finish my geography project.

Must Have To Has To Fill in the blanks with affirmative or negative forms of must or have to has to. Obligation from the speaker. Dalam menggunakan must dan have to untuk menyatakan keharusan kita harus melihat konteksnya.

Have to for objective obligation.