They told me I will receive the. If you did not file your taxes for 2018 you wouldnt receive the payment.

If Only Singaporeans Stopped To Think Gst Voucher 2020 1 4 Million Singaporeans To Receive 570 Million In August 2020

If Only Singaporeans Stopped To Think Gst Voucher 2020 1 4 Million Singaporeans To Receive 570 Million In August 2020

You didnt inform the CRA of a change in.

Did not receive gst. How much you can expect to receive. There could be other reasons like. Your GSTHST credit payments are based on the following.

If you do not receive your payment on the scheduled day wait 10 working days before calling 1-800-387-1193. You have not filed your 2018 tax return. You are generally eligible for the GSTHST credit if you are considered a Canadian resident for income tax purposes the month before and at the beginning of the month in which the Canada Revenue Agency makes a payment.

The enquiry number is 1-800-959-1953. Main GST-free products and services Most basic foods some education courses and some medical health and care products and services are GST-free often referred to as exempt from GST. I have direct deposit and checked it off that I wanted my GST in my tax forms.

If you have a spouse or common-law partner your net incomes are combined to get your family net income. Your net income including your partners if applicable and how many registered children you have under 19 years old. Reinstate your GSTHST payment Canadians who did not file their 2019 returns did not receive their GSTHST credit payments on October 5 2020.

If youre single the amount from line 23600 of your income tax return or the amount that it would be if you completed one. GST credit payments are based on the following 2 factors. Citizens may check their eligibility details and update their payment instruction at the GST.

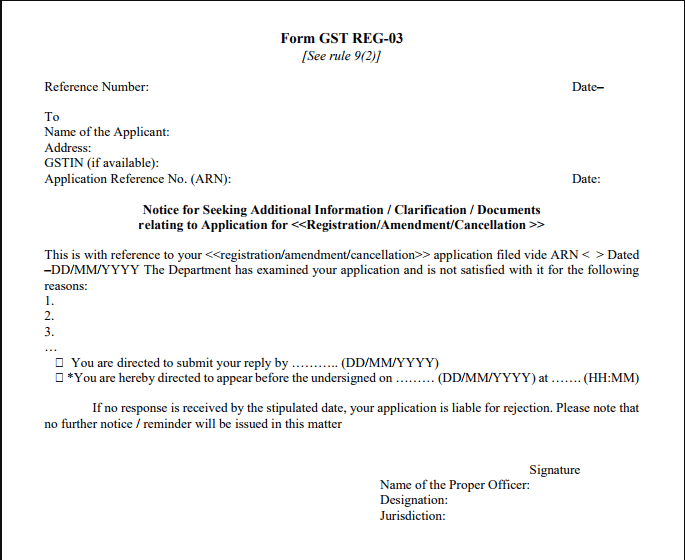

How the one-time additional GSTHST credit payment was. 23 rows GST authorities mainly send out notices when taxpayers operate suspiciously and. However if payment not received from client you may raise credit note anytime to avoid unnecessary gst tax payment on it as a input credit while filing gst return.

The GST Voucher is given in three components - Cash Medisave and U-Save. Your direct deposit information. You can view your GSTHST payment dates and amounts in My Account or by using the MyBenefits CRA mobile app.

Your family net income. Please provide the details of your existing Central Excise. Was wondering if there is anyone on the same boat as me.

Your payment was applied to Family Order. Singles can receive an extra GST credit of 400 while the amount for couples is 600. The permanent GST Voucher scheme was introduced by the Government in Budget 2012 to help lower-income Singaporeans.

Learn more on GST Return Filing Process Procedure 225K views. If you havent received the GST refund for October it could be because you didnt file your 2019 tax returns before the September 31 deadline. Why didnt I receive my GST credit.

I was expecting a gst credit as well which hasnt came yet. Would it come separately from my refund or should I call CRA. But they wont check into anything before the 19th so wait until then to call and GST Credits are sent on the 5th not the 10th.

Your 2018 income tax was reassessed and your income was too high. The Canada Revenue Agency usually send the GSTHST credit payments on the fifth day of July October January and April. Did not receive solidarity payments and GST voucher.

If you do not receive your GSTHST credit payment on the expected payment date please wait 10 working days before you contact us. If you have not received the emergency GST refund it could be because of one or both of the following reasons. You also need to meet one of the following criteria.

I decided to renunce my foreign citizenship and now Im a full fledged Singaporean. Use the GST calculator External Link on ASICs MoneySmart website to work out price excluding GST and the total cost including GST. I understand that I did not receive the solidarity payments at the time bc I was holding dual citizenship.

Yes once sales is occured you need to pay GST on it irrespective of customer pay or not. If youve been getting payments for a while and the amount has suddenly changed its usually because something happened to affect these factors. You may not have received the one-time additional GSTHST credit payment if.

Your personal details like postal address or account details have. Offset the value-added tax The GST. If you have not received your Provisional ID and password for migration to GST or your Provisional ID has been cancelled or you have been unable to migrate due to any reason you may please apply for New Registration on the GST Common Portal at httpsreggstgovinregistr ation.

I filed my taxes late and just got my tax refund through direct deposit.