The CVOR system monitors commercial carrier safety to improve road safety for all road users. Commercial Vehicle Operators Registration.

Cvor Commercial Vehicle Operators Registration

Cvor Commercial Vehicle Operators Registration

How is Cardiovascular Operating Room abbreviated.

What does cvor stand for. This page is about the meanings of the acronymabbreviationshorthand CVOR in the Governmental field in general and in the Transportation terminology in particular. Definition of CVOR in Military and Government. CVOR stands for Cardiovascular Operating Room.

What is the abbreviation for Commercial Vehicle Operators Registration. Commercial Vehicle Operator Requirements Commercial Vehicle Operators Registration. CVOR Stands For.

The conduct of the. Commercial Vehicle Operators Registration. Commercial Vehicle Operator Requirements.

Commercial Vehicle Operators Registration can be abbreviated as CVOR. What does CVOR stand for. A cardiovascular operating room CVOR nurse works as part of the surgical services and operating room teams that treat open-heart cardiovascular patients.

Commercial Vehicle Operators Registration. CVOR means Commercial Vehicle Operators Registration This acronymslang usually belongs to Government Military category. Commercial Vehicle Operator Registration.

Commercial Vehicle Operators Registration. Conventional VHF Omnidirectional Range. CVOR stands for Conventional VHF Omnidirectional Range.

The operator is responsible for. What does CVOR stand for. Colorado Vintage Oval Racers.

Commercial Vehicle Operators Registration. What does CVOR mean in Transportation. CVOR is defined as Cardiovascular Operating Room frequently.

Cardiovascular Operating Room CVOR. Conventional VHF Omnidirectional Range. What does CVOR stand for.

This page is about the meanings of the acronymabbreviationshorthand CVOR in the Governmental field in general and in the Transportation terminology in particular. Commercial vehicle operators registration CVOR Commercial vehicle operators in Ontario must have a valid Commercial Vehicle Operators Registration CVOR certificate and carry a copy. Commercial Vehicle Operator Requirements.

1 definitions of CVOR. A CVOR operator is the person or legal entity responsible for the operation of a commercial motor vehicle. What does CVOR mean in Transportation.

CVOR stands for Commercial Vehicle Operators Registration. Conventional VHF Omnidirectional Range. Commercial vehicle operator records.

Commercial Vehicle Operator Records. Cycling Victoria Off Road. Commercial Vehicle Operators Registration.

Get or renew a CVOR Certificate.

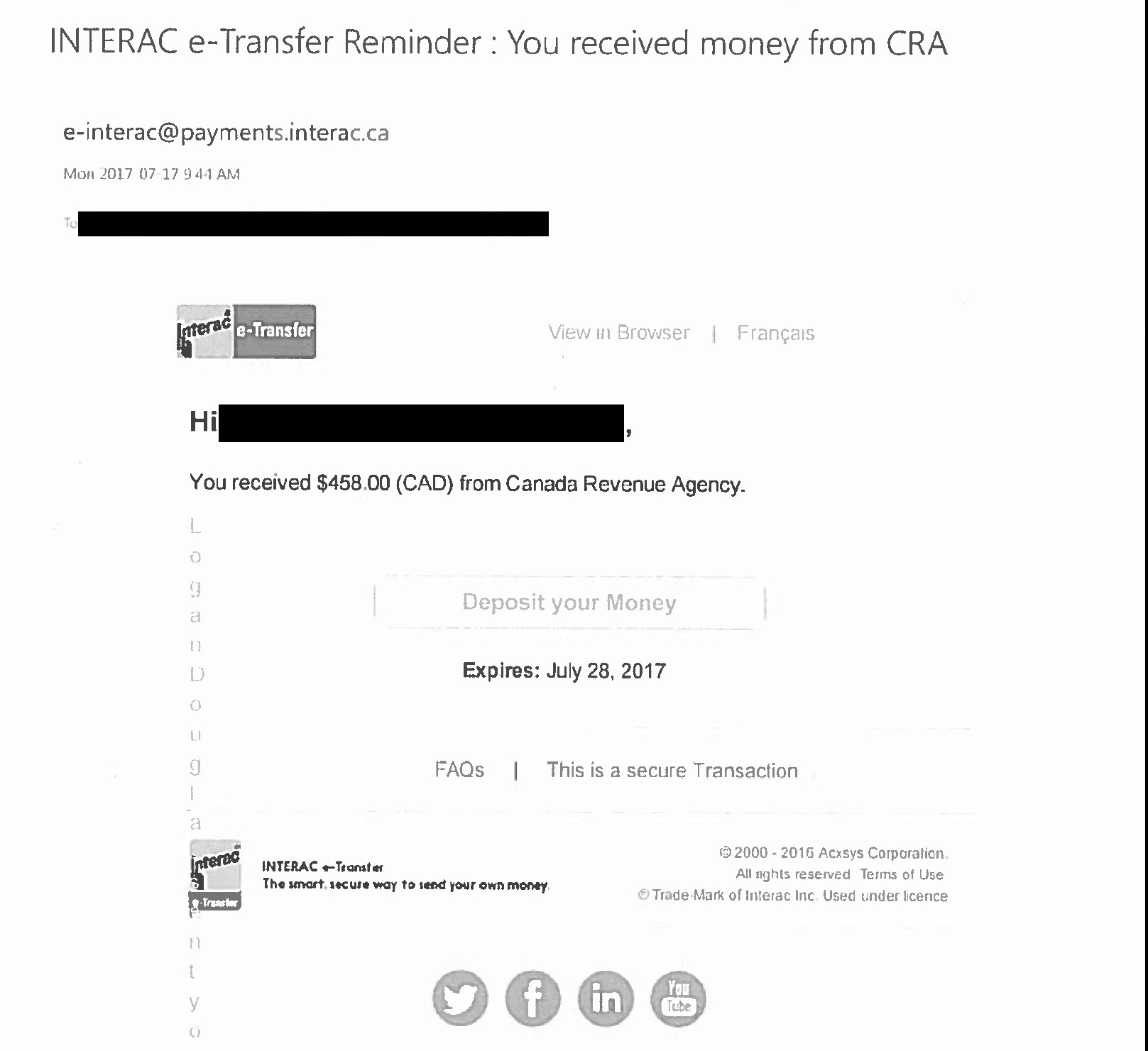

Protecting your personal information poster. This email is bogus especially if its requesting ANY personal information from you such.

Email Tax Scam Claims To Send Refund From Cra Windsor Police Cbc News

Email Tax Scam Claims To Send Refund From Cra Windsor Police Cbc News

The CRA will never.

Does canada revenue agency send emails. The Canada Revenue Agency CRA will never send or request e-transfers of any kind. And you know you didnt subscribe to receive any emails from CRA either. Email you a link to a CRA webpage form or publication that you ask for during a telephone call or a meeting with an agent this is the only case where the CRA will send an email containing links The CRA will never.

The CRA says it does not send unsolicited emails that request personal information or emails that say the recipient owes the agency money. Ad Send or receive faxes quick and easy with WiseFax online fax service. Send fax or get your fax number in just a few seconds.

Give or ask for personal or financial information by email and ask you to click on a link. When you sign up to receive email notifications we will stop sending your mail on paper. When you are registered to receive email notifications from the Canada Revenue Agency CRA we will send you an email to confirm that you are registered for the service.

Additionally the CRA will only send you notification emails if you have subscribed to the service and the email will only advise the user to go into their secure tax account to see relevant. Although the email messages look real using the logos language and look of a true CRA communication it is important to remember again that the Canada Revenue Agency wouldnt just send you an unsolicited email regarding a tax refund. If you receive a e-Transfer claiming to be from the CRA like the example below its a scam.

Ask for financial information such as the name of your bank and its location. Get Results from 6 Engines at Once. Ad Send or receive faxes quick and easy with WiseFax online fax service.

CRA emails Taxpayers only to let them know they have mail in their MyCRA Account. You look bewildered as you havent had any other correspondence from them not even a phone call. Send fax or get your fax number in just a few seconds.

After that when eligible correspondence is available for you to view in My Account or when important changes happen on your account we will send you an email. Ad Search Online Send Fax. Send a link and ask you for personal or financial information.

No the CRA doesnt send or receive payments using e-Transfers. Any email or text message claiming to be from the CRA asking for payment or offering a refund is a scam. Does the Canada Revenue Agency Send e-Transfers.

To retrieve it you will need to log in to My Account. And finally please note that the Canada Revenue Agency NEVER sends emails with amounts refunds or taxes owing. For more information go to canadacataxes-fraud-prevention.

Ad Search Online Send Fax. Notify you by email when something is available for you to view in CRAs digital services. Chinese simplified Chinese traditional Farsi.

Email you a link asking you to fill in an online form with personal or financial details. Email notifications from the Canada Revenue Agency CRA let you know you when you have mail to view in My Business Account and when important changes are made on your account. They would send you a letter by snail mail with a phone number to call one of their representatives.

The CRA will only send you payments by direct deposit or by cheque in the mail. Email you a CRA link form or publication when you request one during a call or a meeting with an agent. With a This is an automatic email message.

CRA will only send you payments by direct deposit or by cheque in the mail. Emails sent from the CRAs email notification service will have the sender name Canada Revenue Agency Agence du Revenu du Canada. If you need a paper copy you can log in to My Business Account and print it.

Send you an email with a link to your refund. Get Results from 6 Engines at Once. The CRA will not do the following.

Give or ask for personal or financial information by email and ask you to click on a link. Rather once you are signed up you will receive an email notification whenever a document has been sent to you by the CRA. You opened up your email today and there was an email from Canada Revenue Agency CRA.

The online mail service does not allow you to receive the documents directly in your email inbox. The Canada Revenue Agency will never send or request e-transfers of any kind.

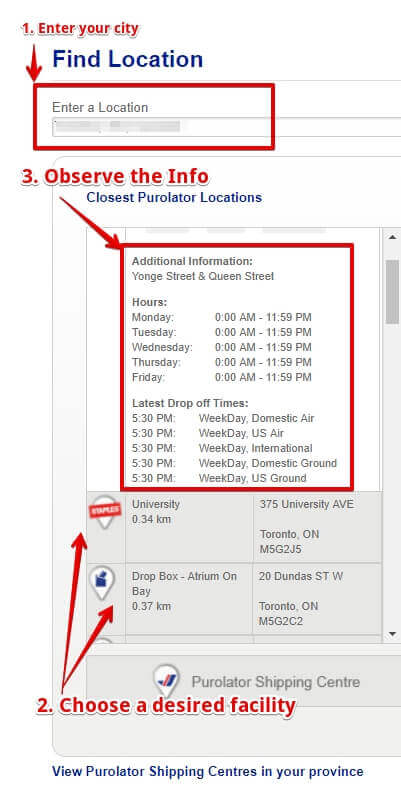

Purolator delivery hours. Choose the speed and price you want with Purolators range of flexible services.

Purolator Canada Usa International Shipping K2track

Purolator Canada Usa International Shipping K2track

Purolator Express delivers the next business day by 900 am 1030 am 12 noon end of day or evening For more flexible shipments Purolator Ground delivers within 2-5 business days by 900 am 1030 am or evening.

Until what time does purolator deliver. I just checked my tracking info and it said 0804 On vehicle for delivery In anyones experience do they usually deliver it by a certain time of day. Unfortunately Purolator does not provide information about delivery on Sundays on their FAQ page. Purolator Same Day delivery offers expedited shipping solutions designed to deliver your parcel when you need it there yesterday.

With this alternative shipments can arrive by the end of one or more business days depending on your destination Purolator Ground Evening. Get your intra-Canada deliveries to their destination on time and on budget. In two or more business days depending on your destination Purolator Ground When you have a less time-sensitive shipment choose Purolator Ground.

Delivery from within 30 minutes to 4 hours After hours delivery. Some exceptions may apply. Based on your shipping requirements we offer two service options for delivery into Canada.

Not applicable to all services. For alternate arrangements please. In another case I had a Purolator driver come close to 4pm.

To select points in Canada delivery will be on the day specifi ed by Purolator. Need it there next day. I checked FAQ about shipping and receiving and there is no information about it.

See Shipping in Canada. Your customers can request to pick up their shipment at a Purolator delivery location in Canada. Purolator Montreal Opens up 0830 today Purolator Ottawa Opens up 0700 today Purolator Regina Opens up 0800 today.

I asked Amazon to put them at the bottom of my courier preferences and I havent had them deliver anything in a year. For full details see Purolator Terms and Conditions of Service or call 1 888 SHIP-123. With this alternative shipments can arrive by the end of one business day or more depending on your.

Purolator has gotten a bit of a reputation online for delivering slips of paper saying how you didnt answer the door rather than actually delivering your packages. Sometimes it takes a little bit more time to deliver a package to your doorsteps due to bad weather conditions and some other reasons. For alternate arrangements please contact us via Live Chat or through our Contact Us page.

I tried to figure out from their website on which hours they deliver but found nothing. Purolator arrived at my house before 8AM in one situation as my parcel was the first off the truck that day. To schedule a pickup please login or register online and select Schedule a Pickup.

According to their online tracking - the package is On vehicle for delivery since 8am so i assume it should arrive today. It works for almost 365 days except for some holidays. Your shipment will be held at our shipping location for a maximum of 5 business days.

They do deliver on weekends at least in Ottawa that I know of. This conspiracy theory has finally been proven because now Canadians have real evidence that Purolator employees dont even try to knock on your door. In two or more days depending on your destination Purolator Ground When you need access to less time-sensitive shipments choose Purolator Ground.

Your shipment will be held at our shipping location for a maximum of 5 business days. Below are the general times for how late the couriers deliver. Purolator Hamilton Opens up 0800 today.

For a residential delivery a notice of delivery will be left advising where the shipment is being held for pickup. You can also call 1 888 SHIP-123 1 888 744-7123 to speak to one of our Customer Service Representatives and schedule a pickup. In most cases end of day means 6 pm.

They may or may not deliver if you have a buzzer number listed on the package but they almost certainly wont if not. Delivery by 1030 am. Delivery by 1030 am.

Additional charges may apply. Purolator delivers every courier on time. Our Representatives are available from 8 am.

For a residential delivery a notice of delivery will be left advising where the shipment is being held for pickup. My normal mail ranges from 8am-7pmyes mad but Ive never had anything shipped with Purolator before. You can never be sure how many other parcels the driver will have to drop off and in what order.

Some exceptions may apply. Delivery times are approximate and not guaranteed. Get guaranteed delivery by end of day Saturday for shipments picked up on Friday or guaranteed delivery by end of the specified day for shipments picked up on Saturday Canadian destinations only.

The Harmonized Sales Tax HST is the combination of Federal GST and Provincial PST into a single value added tax. Depending on the province or territory in which you operate your business you need to collect either a combination of GST and PST GST or only HST.

On March 23 2017 the Saskatchewan PST rose from 5 to 6.

Does manitoba have hst. HST applies in the provinces of Ontario New Brunswick Nova Scotia Prince Edward Island and Newfoundland and Labrador. The HST increased 1 for Prince Edward Island on October 1 2016. The HST like the GST is a value-added tax applied to a wide range of goods and services.

Amount HSTGST variable Total Amount. Quebec has a 5 tax on books and Manitoba has a 5 tax on lodging. Under an HST in Manitoba consumers would pay 405 million more in provincial sales tax.

Province On or after October 1 2016 July 1 2016 to September 30 2016 April 1 2013 to June 30 2016 July 1 2010 to March 31 2013 January 1 2008 to June 30 2010. On July 1 2019 the Manitoba PST dropped from 8 to 7. The provinces that charge GST and their own Provincial Sales Tax are.

2British Columbia-If you live in British Columbia you have to paycharge both 5 GST and 7 PST for a total of 12. When Ontario and BC. The provinces of British Columbia Saskatchewan and Manitoba levy provincial sales taxes PST also known as retail sales taxes in their respective jurisdictions.

Currently five provinces Ontario New Brunswick Nova Scotia Newfoundland Labrador Prince Edward Island no longer have a provincial sales tax - they have merged their provincial sales tax with the federal GST and now charge a single Harmonized Sales Tax HST. In Alberta like the territories they do not have HST or a provincial sales tax they just have GST. Alberta British Columbia 5 GST British Columbia 12 Manitoba 5 GST Manitoba 12 New-Brunswick Newfoundland and Labrador 15 Northwest Territories Nova Scotia Nunavut Ontario Prince Edward Island Québec GST 5 Québec QST 9975 Québec QSTGST 14975 Saskatchewan 6 PST Saskatchewan 11 Yukon.

Paskowitz says that Canadian businesses that do not expect to have at least 30000 in annual revenues are not required to have a GSTHST number but you could consider registering for one anyway. In Manitoba provincial sales tax is called retail sales tax RST and is charged at a rate of 8. Getting a bit technical for a moment.

These fall into three categories. Lastly if your customer was based out of Vancouver BC making the place of supply British Columbia then you would charge them 5 GST plus 7 PST. Manitoba-If you live in Manitoba you paycharge both 5 GST and 8 PST for a total of 13.

In 1996 three of the four Atlantic provinces New Brunswick Newfoundland and Labrador and Nova Scotia entered into an agreement with the Government of Canada to implement what was initially termed the blended sales tax renamed to harmonized sales tax which would combine the 7 federal GST with the provincial sales taxes of those provinces. Your accountant can help you figure out exactly which taxes apply to your specific business. Provinces Where Only GST Is Due.

So that means your business may need to collect additional taxes depending on the special taxes in your province and the type of business you run. 14 rows The HST is in effect in Ontario New Brunswick Newfoundland and Labrador Nova Scotia. For purposes of illustration assume you operate a small business in Manitoba selling stained glass ornaments and art objects that youve designed and need to know how to charge RST.

The provincial sales tax in Manitoba is called RST Retail Sales Tax. 4New Brunswick-If you live in New Brunswick you paycharge 15 HST 5 GST and 10 PST. Provinces such as Ontario charge a single harmonized sales tax HST.

As part of this project the PST portion. Harmonize this summer only PEI Saskatchewan and Manitoba will not have the HST. The federal government and all HST provinces provide several forms of offsets to reduce the cost of GSTHST for households.

Manitoba Government departments and entities are exempt from the federal Goods and Services Tax GST and Harmonized Sales Tax HST on direct purchases. As of July 1 2016 the HST rate increased from 13 to 15 for Newfoundland and Labrador and New Brunswick. Merchants in Manitoba are required to pay GST and RST for all sales made.

Canada does not have a formal self-billing program. I actually recommend doing so since non-registered businesses. Not all provinces have HST but the ones that do are.

Below is a list of entities that are exempt from GSTHST on such purchases of property or services. 14 rows HST Total Tax Rate Notes. Please note that the list is subject to change.

Point-of-sale exemptions rebates for new housing and low-income tax credits.

If you burnish something such as your public image. Reflecting a sheen or glow.

How To Burnish Leather Edges 4 Steps With Pictures Instructables

How To Burnish Leather Edges 4 Steps With Pictures Instructables

Collectors often refer to the coins as bearing a Burnished Uncirculated finish.

What does burnished mean. The inside are decorated with burnished patterns in which some areas are left matte. To rub with a tool that serves especially to smooth or. Burnished coins appear matte and less shiny when compared to a standard bullion coin.

And his feet like unto fine brass - Compare Daniel 106 And his arms and his feet like in color to polished brassSee also Ezekiel 17 and they the feet of the living creatures sparkled like the color of burnished brassThe word used here - χαλκολιβανω chalkolibano - occurs in the New Testament only here and in Revelation 218. Burnished burnishing burnishes 1. Burnished coins have an artificially polished surface that is generally considered to be detrimental to the value of the coin and should be mentioned in its description.

To burnish something means to make it shiny or lustrous especially by rubbing. Burnishing can also be applied to wood by. Burnish definition to polish a surface by friction.

Made smooth and bright by or as if by rubbing. BURNISHED adjective The adjective BURNISHED has 1 sense. To improve or make more impressive.

To make shiny or lustrous especially by rubbing burnish leather burnishing his sword. To rub a material with a tool for compacting or smoothing or for turning an edge pottery with a smooth burnished. BURNISHED used as an adjective is very rare.

To rub metal until it is smooth and shiny 2. To rub with a tool that serves especially to smooth or polish. Smooth and shiny usually because of being polished rubbed.

To make smooth or glossy by rubbing. What does Revelation 115 mean. In the world of numismaticsthe study of coins and currencya burnished coin is more than a.

Reflecting a sheen or glow Familiarity information. To make smooth or glossy by rubbing. The Mint began selling the American Eagle 2006-W Anniversary three-set piece.

Numismatists use the term burnished to describe the coins unique finish. This technique can be applied to concrete masonry creating a polished finish. Princetons WordNet 000 0 votesRate this definition.

Entry 1 of 2 transitive verb. Burnished synonyms burnished pronunciation burnished translation English dictionary definition of burnished. Bright burnished lustrous shining shiny adj made smooth and bright by or as if by rubbing.

To make shiny or lustrous especially by rubbing burnish leather burnishing his sword. A coin collector may burnish a coin that has been tarnished or marred by poor storage conditions or prior circulation in an effort to improve the coins look and feel with the mistaken belief that it will increase the coins value. Polish sense 3 attempting to burnish her image.

Information and translations of Burnish in the most comprehensive dictionary definitions resource on the web. Achievements that burnished her reputation. What does Burnish mean.

Polish sense 3 attempting to burnish her image. Some collectors believe burnishing adds longevity to the design. Of a colour shining in a.

See verse text John describes Jesus further as having feet like burnished brass refined in a furnace. This is the result of polishing the blanks before they are struck. What does it mean to burnish something.

What does burnished mean. Likely the reference is to brass that has turned white in the process of burning.