The federal government charges an excise tax at a flat rate of 10 cents per litre on gasoline in effect at that rate since 1995 and 4 cents per litre on diesel in effect at that rate since 1987. The price increase translates to 88 cents per litre of gasoline as of April 1 2021 for the regular consumer according to the Canada Revenue Agency.

Ontario Convenience Stores Association Gas Retailers Federal Carbon Tax Transparency Stickers

Ontario Convenience Stores Association Gas Retailers Federal Carbon Tax Transparency Stickers

I can calculate the impact on heating and gasoline.

Ontario carbon tax on gasoline. Furnace oil is exempt from this tax and there is no federal excise tax on natural gas or propane. It reduced my 2020 income tax payable by 450. The federal tax is 20 a tonne for this year but its set to increase by 10 annually until April 2022.

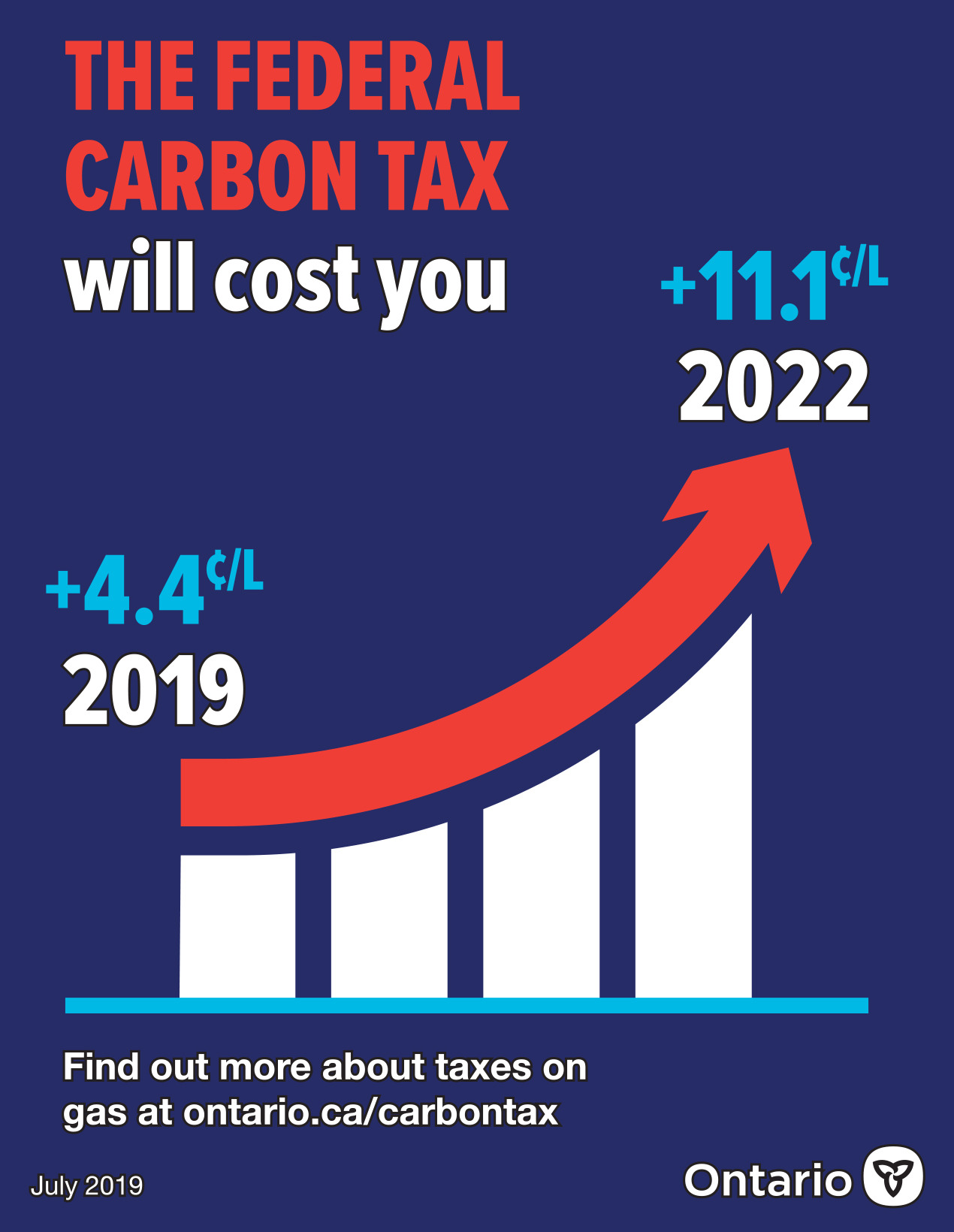

According to the Canada Revenue Agency this years 10 per tonne hike will increase the total federal carbon tax charge for gasoline to 88 cents per litre. This year the deemed price for a ton of Canadian greenhouse gas emissions GHG is going up by 33 to C40ton 32. Here in Ontario the fuel charge on gasoline in 2019 will be 442 cents per litre.

Generally Ontario imposes a direct tax on gasoline products which is payable by consumers. There is no carbon tax on Hydro in Ontario. In the wake of that March 25 decision Campaign.

In a landmark ruling Thursday the Supreme Court ruled Ottawa has the authority to impose a carbon price across the country as a matter of national concern The current 30 per tonne. The increase in carbon tax on April 1 will translate to an extra 88 cents per litre of regular gasoline for the average consumer according to the Canada Revenue Agency. The findings come after Ontario Alberta and Saskatchewan lost their Supreme Court challenge against Ottawas carbon tax last month.

Prime Minister Justin Trudeau today released the governments strategy to dramatically reduce greenhouse gas emissions by 2030 and. This means that persons who purchase or receive delivery of gasoline products for their consumption or for someone else at their expense must pay the gasoline tax. For consumers the federal minimum price started at 20 per tonne of CO2 equivalent in 2019.

As of this April its 40 rising to 50 in 2022 and increasing. I have no idea how much of an offset this is. The decision of the Supreme Court of Canada to uphold the constitutionality of the national carbon tax scheme under the Greenhouse Gas Pollution Pricing Act alters the landscape for the countrys climate law and gives the federal government unambiguous constitutional authority to establish an effective national greenhouse gas GHG pricing.

Based on federal figures the tax in the four non-compliant provinces will result in an approximate cost increase of 442 cents a litre for gasoline 537 cents for light fuel oil home heating. For consumers the carbon price translates into 2021 taxes of C66. 23 rows The rates reflect a carbon pollution price of 20 per tonne of carbon dioxide.

Ottawa to hike federal carbon tax to 170 a tonne by 2030. How much is Canadas carbon price. The current price on carbon translates to Canadians paying roughly an extra 23 cents per litre of gasoline which is set to rise to an extra 12 cents per litre under the 50 per tonne pricing in.