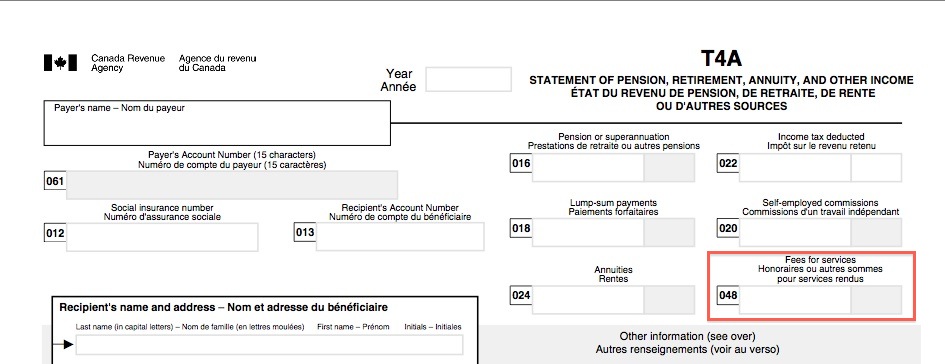

Description of a T4A or Statement of Pension Retirement Annuity and Other Income a Canadian tax document issued by an employer trustee estate executor or liquidator to declare income received during a tax year and the amount of income tax deducted. The tax T4A covers all income types especially those not included in other tax slips.

Cra Subcontracting Reporting Requirements

Cra Subcontracting Reporting Requirements

Since the beginning of January the Canada Revenue Agency CRA has been issuing T4A slips to individuals who received COVID-19 emergency and recovery benefits from the CRA in 2020.

What's a t4a. As a student your T4A slip will likely report the scholarship or bursary income you received while you were enrolled at an educational institution. Ad Wide Selection of Tools Hardware from Heyco. Generally youll only receive a T4A slip from the payer of these income sources if the total of the payments was more than 500 in the year or if income tax was deducted from the payments.

Essentially a T4A reflecting income from services youve performed indicates that youre self-employed not an employee. They mist be filed with CRA by 28 Feb of each year same time as T4 and T5 slips. T4A vs T4 Slip.

Regardless of your financial year end T4As are based on a Jan to Dec calendar year. These benefits are taxable and the information on T4As is needed when individuals are filing their taxes this year. You will receive a T4A tax slip when you receive income from pensions retiring allowance annuities or other income.

Customized T4A slips For those who fill out a large numbers of slips we accept slips other than our own. Similar to T4 slip this has the tax year Payers name and. While the information found on each will vary they do share one important characteristic - theyre all used to complete your income tax return.

Ad Wide Selection of Tools Hardware from Heyco. T4A is generally issued when the payment was made over 500. You also use this slip for recording fees you pay for someones self-employment income or alternative forms of income.

To ensure accuracy follow the guidelines for the production of customized forms or see the current version of Information Circular IC97-2R Customized Forms. Non employment income type payments made to individuals should be reported on a T4A slip. Allied is the Distributor of Choice for Industrial Automation Control.

There are penalties for late filing or not filing T4A slips and the penalty is PER SLIP not one penalty for all slips. The T4A is a Statement of Pension Retirement Annuity and Other Income. The T4A is an official document for tax purposes that shows all other income you have received from January to December in any given year.

What is a T4A tax form. CIHR NSERC or SSHRC scholarships and bursaries. This excludes the buying of physical goods and supplies.

You will receive a T4A from the university if you have received any. It differs from a T4 in that it is not merely income earned through employment and differs from T5s in that it is also not investment income. It applies in case of self-employed commission income pensions annuities fees for services scholarships and other income.

We are only talking about services here. While the T4 and T4A slips may seem similar the T4 includes more detail around various payroll contributions that you have as. Allied is the Distributor of Choice for Industrial Automation Control.

Meanwhile fill out a T4A Statement of Pension Retirement Annuity and Other Income slip for contributions you make to someones pension or annuities or lump-sum payments you make in lieu of hourly wages. The T4A slip is a form used to report a statement of pension retirement annuity and other income. What is a T4A.

The blog explained that the way the rule is written in the tax act a T4A should be issued for any individual or company that you pay for any fee or service. It reports all applicable income and deductions. It means a person who is salaried working as a part of the entity that pays him or her.

When will I receive it. The T4 tax form is used to indicate income from an employer. Whats the difference between a T4 a T4A and T4AP slip.

These include commissions paid to self-employed individuals lump sum payments pensions etc. What other type of income can be included. If youre a student and new to filing a tax return you might be a little unclear on what some of the slips youre receiving are for.

A full list of the types of income and the corresponding codes. Some of these payments represent taxable income. In short a T4A is a statement of other income that you must report to the CRA and pay appropriate taxes on.

T4As reflect income you earn as an independent vendor more likely to issue invoices than to receive a salary. If you have received any self-employment income throughout the past year you report it as a T4A vs.