Use pre-authorized debit and select Payment on Filing. In addition another 1 penalty fee is added every month that the balance remains unpaid.

Cra Payments Cccu Remote Banking Self Serve Info Hub

Cra Payments Cccu Remote Banking Self Serve Info Hub

Penalties for Filing Late The CRA discourages late filers by adding a flat 5 penalty charge on any balance that is owed as of the passed deadline.

/https://www.thestar.com/content/dam/thestar/business/2021/03/23/independent-business-lobby-group-urges-delay-in-tax-deadlines/cra_ottawa.jpg)

Cra payment on filing. To access the form on online banking select More Services from the left navigation. Select Payment on Filing. However the CRA has made no announcements to delay.

Most services also allow you to schedule payments in advance so you dont forget. The CRAs Get Ready page has information about filing deadlines and CRA. The CRA delayed the tax filing and payment deadlines by several months to help Canadians prepare their taxes.

Hello and welcome to our webinar on the new Payment on Filing policy a new Canada Revenue Agency CRA policy which will assist employers in their year-end remittance obligations. You can also set up several recurring payments if you need to make periodical remittances. A payment form is a document that provides a format or guidance on how to calculate an amount.

That was withheld on these payments by filing. The policy will allow eligible employers to submit a reconciliation payment to the CRA on or before the last day of February without being subject to a penalty or interest. The following CRA Canada Revenue Agency tax payments can be paid using the bill payment feature on EasyWeb and the TD app for Smartphone and Tablet.

Using this option you can authorize the CRA to withdraw a predetermined payment on a predetermined date directly from your bank account to pay whatever you owe. When COVID-19 struck in mid-March 2020 the Canada Revenue Agency CRA didnt waste time extending the tax filing and tax payment deadlines. The CRA will honor the date the mail is received by CRA and not the postmarked date by Canada Post.

Part XIII non-resident withholding tax. Most major banks have a tax filingpayment service that enables you to quickly make payments online from your business chequing account. The CRA is offering further relief from late-filing penalties for individual corporate and trust income tax returns although the previously extended filing due dates are unchanged.

Submit a PoF reconciliation payment. The CRA is seeking T1 returns from individuals by June 1 2020 in order to ensure accurate federal and provincial benefits payments. For individual returns this means that the date for late-filing penalty relief was extended to September 30 2020 from September 1 2020.

Attach a cheque to your T4 summary and mail it to us. The filing deadline for individuals is April 30. You can make your payments through the following methods.

Youll need your CRA business number the applicable period for the payment and the due date. Payment date for 2019 tax year. To set up direct deposit payments with the CRA you have to complete the registration form on Simplii Financial Online Banking or our mobile banking app.

Most individuals had until. Benefits and credits repayments. PAD is an online self-service form of payment that is managed using the My Account online tool.

Media Relations Canada Revenue Agency. The deadline for paying a liability without interest or penalty was Sept. Select to show or hide answer.

Individual Income tax T1 including instalments and amount owing. For self-employed individuals its June 15. Personalized remittance vouchers for Individual instalments and amount owing are available for downloading and.

Golombek suggested the CRA is unlikely to extend the tax filing deadline this year as it did for the 2019 tax year when the filing deadline was extended to June 1 2020. CRA Extends Filing and Payment Due Dates In order to provide greater flexibility to Canadians who may be experiencing hardships during the COVID-19 outbreak the Canada Revenue Agency will defer the filing due date for the 2019 tax returns of individuals including certain trusts. In addition following the deadline compound daily interest starts to accrue.

Choose the type of payment you want to make. A remittance voucher is a slip that provides Canada Revenue Agency CRA specific account information and has to accompany your payments. The Canada Revenue Agency CRA moved the tax deadlines filing and payments for the 2019 taxes due to the COVID-19.

CRA Personal Income Tax payment when filing use this option to make your annual tax filing payment the amount owing on your tax return. My Business Account MyBA. September 1 2020 Penalties including late-filing penalties and interest will not be applied if returns are filed and payments are made by September 1 2020.

Https Www Cibc Com Content Dam Small Business Cash Management Gpfs Point Of Sale En Pdf

Cra Updates On Filing Deadlines Connelly And Koshy

Canada Revenue Agency On Twitter The Deadline To File Your Income Tax And Benefit Return Has Been Extended From April 30th To June 1st 2020 The Deadline To Pay Any 2019 Balance

Canada Revenue Agency On Twitter The Deadline To File Your Income Tax And Benefit Return Has Been Extended From April 30th To June 1st 2020 The Deadline To Pay Any 2019 Balance

Cra S Tax Filing And Payment Deadlines For 2019 Think Accounting

Cra S Tax Filing And Payment Deadlines For 2019 Think Accounting

/https://www.thestar.com/content/dam/thestar/business/2021/03/23/independent-business-lobby-group-urges-delay-in-tax-deadlines/cra_ottawa.jpg) Independent Business Lobby Group Urges Delay In Tax Deadlines The Star

Independent Business Lobby Group Urges Delay In Tax Deadlines The Star

Cra Puts Focus On Paper Returns As Tax Filing Season Opens Chilliwack Progress

Cra Puts Focus On Paper Returns As Tax Filing Season Opens Chilliwack Progress

Don T Let Cra Tax Interest Relief Tempt You Into Filing Late Experts Warn Advisor S Edge

Don T Let Cra Tax Interest Relief Tempt You Into Filing Late Experts Warn Advisor S Edge

Dunya Akhirah How To Pay Taxes To Cra Using Td Online Banking Account Is Sin

Dunya Akhirah How To Pay Taxes To Cra Using Td Online Banking Account Is Sin

How To Submit Federal Payroll Deductions Payment To Cra Youtube

How To Submit Federal Payroll Deductions Payment To Cra Youtube

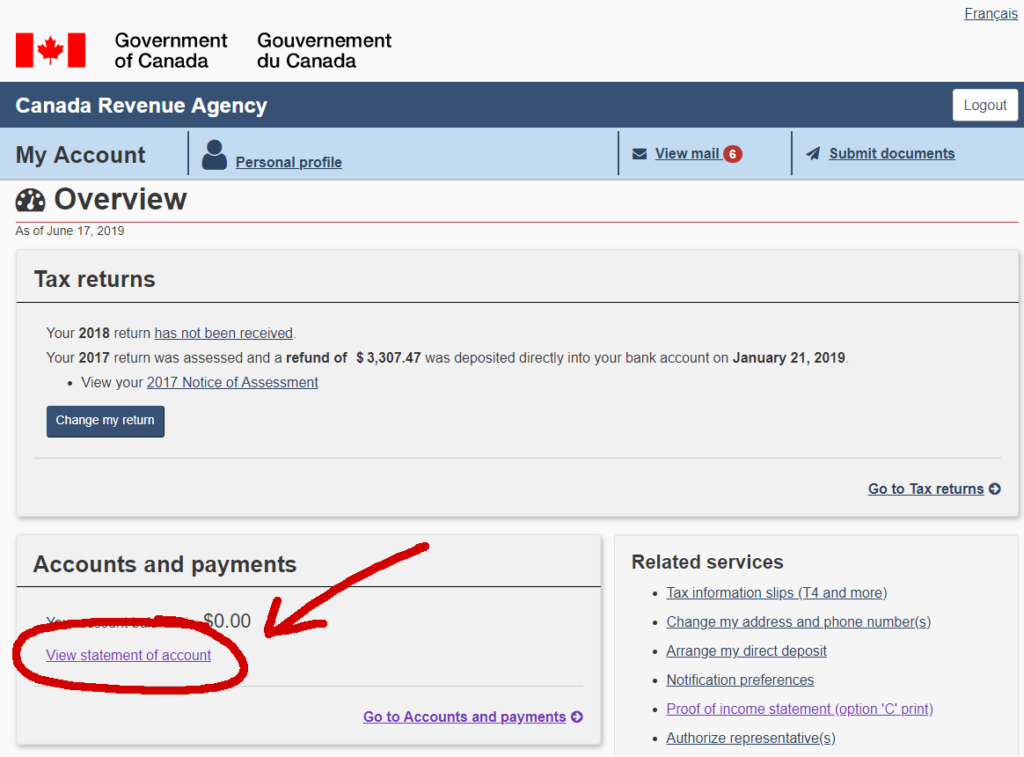

Cra Statement Of Account Mackenzie Gartside Associates

Cra Statement Of Account Mackenzie Gartside Associates

Schell And Associates Chartered Accountants In Victoria Bc

Schell And Associates Chartered Accountants In Victoria Bc

Cra And Covid 19 Income Tax Filing And Payment Deadlines

Cra And Covid 19 Income Tax Filing And Payment Deadlines

Cra Statement Of Account Mackenzie Gartside Associates

Cra Statement Of Account Mackenzie Gartside Associates