If you choose the detailed method to calculate meal expenses you must keep your receipts and claim the actual amount that you spent. The CRA announced it is increasing the amount that an employer can use to determine whether an overtime meal or allowanceor the meal portion of a travel allowanceis taxable to 23 from 17.

Let S Say Thanks To Ottawa For New Cra Meal Allowance Policy Canadian Trucking Alliance

We realize there are many requests from other industries as a result of COVID-19 but we.

Meal allowance canada. From Everything To The Very Thing. Meal Allowance and Taxation for Canadians Canadian Tax Authority Tweaks Taxation of Employee Benefits The Canada Revenue Agency CRA released Income Tax Technical News ITTN No. Ad Get Allowance With Fast And Free Shipping For Many Items On eBay.

Although you do not need to keep detailed receipts for actual expenses if. The rate is stated in the CRA Guide T4130. 40 which deals with administrative policy changes for taxable employment benefits including over-time meals and allowances employer-provided motor vehicles and.

Looking For Great Deals On Allowance. The new policy is effective immediately and retroactive to January 1 2020. CRA usually considers an allowance to be reasonable if it covers the out-of-pocket expenses incurred by an employee who is travelling for employment purposes.

If you use the simplified method you do not have to keep meal receipts. Meals and incidentals 100 up to 30 th day 11215. An allowance can be calculated based on distance time or something else such as a motor vehicle allowance using the distance driven or a meal allowance using the type and number of meals per day.

Under either the simplified or detailed method you can claim one meal after every 4 hours from the departure time to a maximum of 3 meals per day. Meal allowance total 75 31 st to 120 th day 7115 7840 8940. Questions on per diem meal allowance.

Give us a call and well happily answer them. If you choose the simplified method claim in Canadian or US funds a flat rate of 23meal to a maximum of 69day sales tax included per person without receipts. Ad Our comprehensive guide to the best Niagara Falls Luxury Hotels 2020.

The simplified method flat rate for meal allowance will now increase from 17 to 23 per meal. This is up to a total of three meals per day at a rate of 23 per meal. Travel in Canada Canadian taxes included Canada all Provinces USA.

If you want to claim three meals per day you multiply the meal rate of 23 by three for a total of 69. Under either the simplified or detailed method you can claim one meal after every 4 hours from the departure time to a maximum of three meals per day. From Everything To The Very Thing.

Ad Get Allowance With Fast And Free Shipping For Many Items On eBay. Likewise the CRA has also increased the rate at which transport employees and certain other individuals can claim meal expenses using the. Adjusting the meal allowance is a reasonable and meaningful way for the government of Canada to recognize the efforts of Canadian truck drivers Spencer wrote.

CRA per diem meal allowance rates. Meal allowance total 50 121 st day onward 4745 5225 5965 7560 13 Incidental allowance 100 up to 30 th day 1730 1730. For the purposes of calculating the maximum number of meals allowed a day is considered to be a 24-hour period that begins at the departure time.

13 rows 1. Ad Our comprehensive guide to the best Niagara Falls Luxury Hotels 2020. Increased reasonable meal allowance for 2020 The Canada Revenue Agency CRA increased to 23 up from 17 as the amount that an employer can use to determine whether an overtime meal or allowanceor the meal portion of a travel allowanceis taxable.

Incidental allowance 75 31 st day onward 1300 1300. Looking For Great Deals On Allowance. Then multiple this number by 80 the result of 5520 is the amount you may claim.

Today the Honourable Marc Garneau Minister of Transport on behalf of the Honourable Diane Lebouthillier Minister of National Revenue announced that the Canada Revenue Agency CRA has increased the amount that employers can use to determine whether an overtime meal or allowance or the meal portion of a travel allowance is taxable from 17 to 23. A reimbursement is an amount you pay to your employee to repay expenses he or she had while carrying out the duties of employment. For the purposes of calculating the maximum number of meals allowed a day is considered to be a 24-hour period that begins at the departure time.

Https Www Ic Gc Ca Eic Site 118 Nsf Vwapj At Accessible Detailed Claim Advance Instructions Eng Pdf File At Accessible Detailed Claim Advance Instructions Eng Pdf

Ooida Supports Meal Allowance Plan For Canadian Truckers Land Line

Ooida Supports Meal Allowance Plan For Canadian Truckers Land Line

Erb Group Of Companies On Twitter The Canadian Government Has Increased The Meal Allowance For Drivers From 17 To 23 Effective Immediately And It Will Be Retroactive To January 1st 2020 Thank

Erb Group Of Companies On Twitter The Canadian Government Has Increased The Meal Allowance For Drivers From 17 To 23 Effective Immediately And It Will Be Retroactive To January 1st 2020 Thank

Air Canada Component Of Cupe Educational Series Your Pay Summary

Air Canada Component Of Cupe Educational Series Your Pay Summary

Meal Allowance Change Government Of Canada Invests And Supports Canada S Commercial Truck Drivers Canadian Trucking Alliance

Air Canada Component Of Cupe Educational Series Your Pay Summary

Air Canada Component Of Cupe Educational Series Your Pay Summary

The New Canada Food Guide Considerations For Periodontal Health

The New Canada Food Guide Considerations For Periodontal Health

Air Canada Component Of Cupe Educational Series Your Pay Summary

Air Canada Component Of Cupe Educational Series Your Pay Summary

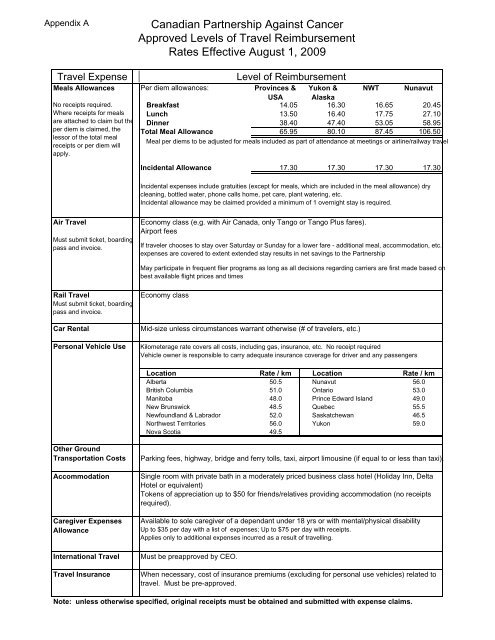

Travel Expense Claim Forms Pdf

Travel Expense Claim Forms Pdf

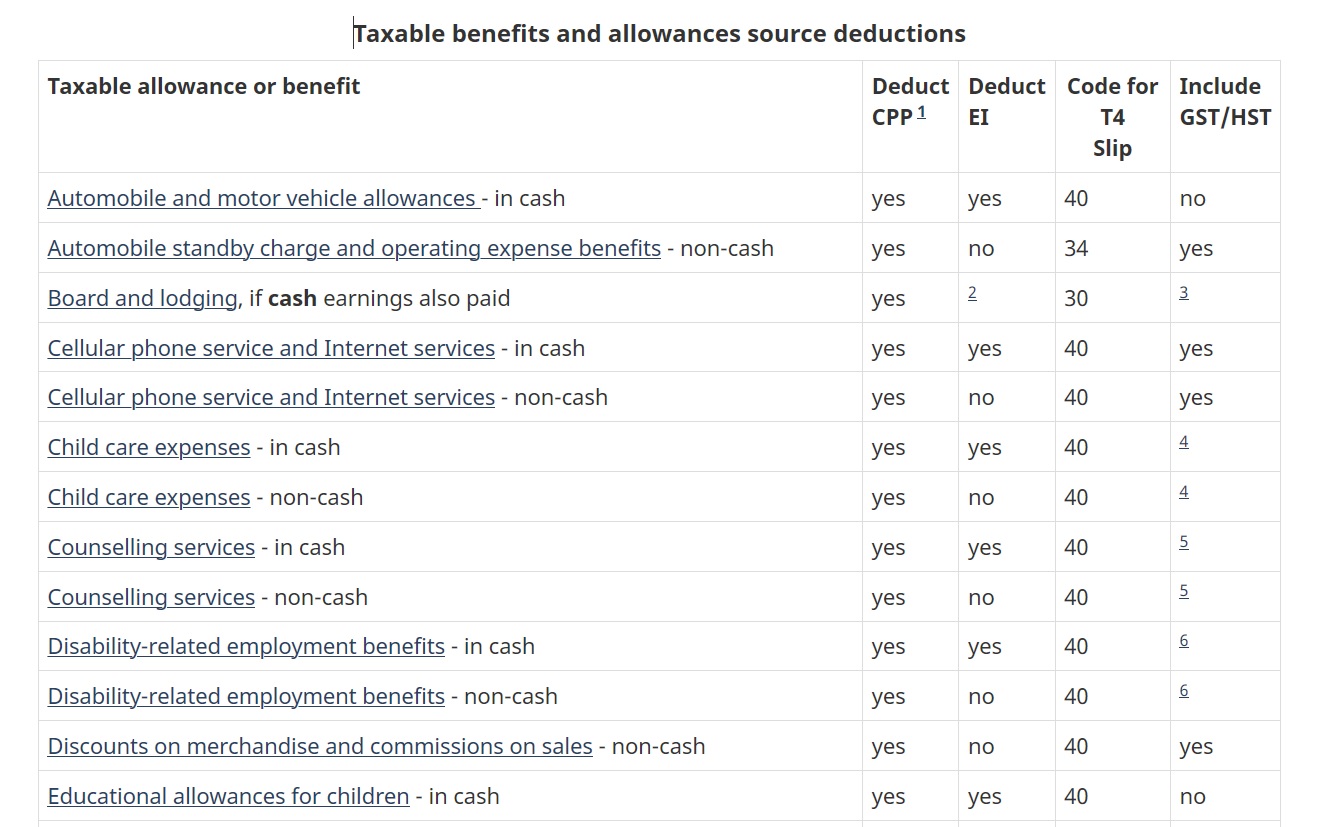

Helpful Resources For Calculating Taxable Benefits Canada The Art Of Accounting Burlington

Helpful Resources For Calculating Taxable Benefits Canada The Art Of Accounting Burlington

Cta On Twitter Thanks Ottawa For Increasing The Meal Allowance For Commercial Drivers To Learn More About This Change Click Here Https T Co Tpdso77h98 Https T Co 6icoaq1ovi

Cta On Twitter Thanks Ottawa For Increasing The Meal Allowance For Commercial Drivers To Learn More About This Change Click Here Https T Co Tpdso77h98 Https T Co 6icoaq1ovi

-

All Highway 11 Ontario Traffic Cameras DOT Accident and Construction Reports On US 97A at milepost 213 south of Entiat for 2 weeks starting...

-

Employment Ontario Second Career Internet Site. It is provided based on need and applicants may need to contribute to cost of the training....

-

Tallman Truck Centre Limited. 57 Kenneth Ave. Tallman Truck Centre Limited Archives Truck News Tallman Truck Centre Limited retails truc...

jesus loves us so much

Yes, Jesus Loves Us That Much! Hearing From Jesus . Jesus clearly went willingly to His torture and death. God loves us all so much th...

ads