Individual income tax enquiries 1-800-959-8281. Complete an Address Change Request Form.

Http Iiac Ca Wp Content Uploads Iiac Cra Letter With Respect To Requirements To Pay May 17 2013 Pdf

TIPS automated information 1-800-267-6999.

Cra address ontario. Change an address for someone else by mail. How the CRA decided on the amount. Send a notification to Canadian Revenue Agency CRA without any delay.

Sudbury Tax Centre 1050 Notre Dame Avenue Sudbury ON P3A 5C2 Canada Fax. Sign in to a CRA account. You can update your information online using the CRAs My Account service or by calling the CRA at 1-800-959-8281.

Benefits enquiries GSTHST CCB 1-800-387-1193. Contact information for the Canada Revenue Agency CRA phone numbers mailing addresses. Countries other than the USA United Kingdom France Netherlands or Denmark.

Administering tax laws for the Government of Canada and for most provinces and territories. Complete Form RC325 Address change request. Contact the Canada Revenue Agency.

Provincial Programs for Ontario PPO Enquires related to Ontario Sales Tax Credit OSTC Ontario Sales Tax Transition Benefit OSTTB Ontario energy and property tax credit OEPTC payment Northern Ontario energy credit NOEC payment and Ontario Senior Homeowners Property Tax Grant OSHPTG payment. Whether you owe money because the CRA paid you too much. If you have a hard copy of your CRA tax returns and need to find the mailing address simply choose and click on the state.

While relocating your office you have to change the physical address. This Web page provides contact information for provincial and territorial Canada Revenue Agency CRA tax services offices and tax centres. You will also want to have all the following on hand.

Change your address by mail. Go to the official Government of Canada website and in My Business Account use Manage Address service. Here is a general list of phone numbers to help you contact the CRA.

The full legal name of the business. If you are on think of where do I send my tax return then let us tell you the mailing address for your tax return depends on the state or territory that you live in and on the type of form that you are filing. Include a signed letter with your form that contains the individuals.

The CRAs headquarters are located in Ottawa and is responsible for several Agency-wide functions including ministerial reporting corporate planning human resources information technology communications and interpreting tax. Belleville Hamilton Kingston Kitchener Waterloo London Ottawa Peterborough St. This Web page provides contact information for provincial and territorial Canada Revenue Agency CRA tax services offices and tax centres.

Whether youre eligible to get the Canada child benefit CCB how much CCB money youll get. Ottawa Technology Centre T3 Estate and Trust Returns Canada Revenue Agency 875 Heron Road Ottawa ON K1A 1A2 Additional mailing information for T3 returns can be found at CRA website httpwwwcra-arcgccanwsrmtxtps2013tt131104-enghtml. Canada Revenue Agency wwwcragcca.

You may disagree with a decision that the Canada Revenue Agency CRA makes about. An external drop box is available for correspondence and payments. The Canada Revenue Agency CRA requests notice of a change of address as soon as possible.

You may also change the address of another individual at the same time such as your spouse or common-law partner. You have 3 ways to accomplish this process. Canada Revenue can be contacted for in a number of ways.

Check the anticipated wait times to speak to a CRA agent. Catharines Thunder Bay or Windsor. The Agency also accepts address changes by mail.

Call 1-800-959-5525 between 9 AM and 6 PM from Monday to Friday. You can print and complete the address change request form and mail it to the appropriate tax center listed on the bottom of the form. You may fill it in online then save it to file or print sign it and then send it to your tax center following the CRA.

Sometimes you can fix the problem by talking. Mail the completed form to the address on the forms. Corporation address change application form is used for existing Ontario or Federal corporations in changing corporate address directors address etc.

Many contact the CRA to find information on their assessments as well as information about their tax refunds etc. CRA tax return. Your clients business information including.

Connaught Building headquarters of the Canada Revenue Agency. Ensure that you have the authorization to speak to the CRA on behalf of your client. How to Contact the CRA.

There is no walk-in counter services offered at any CRA locations.

Canada Revenue Agency Taxation Centre In Sudbury Covid 19 Pandemic Sudbury Star

Canada Revenue Agency Taxation Centre In Sudbury Covid 19 Pandemic Sudbury Star

The Cra Just Redesigned The T1 Personal Income Tax Return Form And There Are Some Major Changes Financial Post

The Cra Just Redesigned The T1 Personal Income Tax Return Form And There Are Some Major Changes Financial Post

We Wrote A Letter To The Cra About T183 Forms Zenbooks

We Wrote A Letter To The Cra About T183 Forms Zenbooks

Notifying Canada Revenue Agency Cra Of A Change Of Address 2021 Turbotax Canada Tips

Canada Revenue Agency Mississauga Address Contact Maps Hours Support

Canada Revenue Agency Mississauga Address Contact Maps Hours Support

How To Change Your Address With Canada Revenue Agency 6 Steps

How To Change Your Address With Canada Revenue Agency 6 Steps

How To Change Your Address With Canada Revenue Agency 6 Steps

How To Change Your Address With Canada Revenue Agency 6 Steps

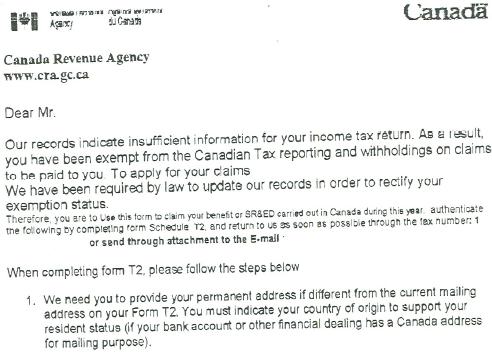

Fake Revenue Canada Letters Used To Steal Personal Info Sudbury Com

Fake Revenue Canada Letters Used To Steal Personal Info Sudbury Com

How To S Wiki 88 How To Address A Letter To Canada Revenue Agency

How To S Wiki 88 How To Address A Letter To Canada Revenue Agency

![]() Contact The Canada Revenue Agency Canada Ca

Contact The Canada Revenue Agency Canada Ca

Cra Scam No The Cra Will Never Send Your Tax Refund Via E Transfer

Cra Scam No The Cra Will Never Send Your Tax Refund Via E Transfer

How To S Wiki 88 How To Address A Letter To Canada Revenue Agency